MarketWatch/Barbara Kollmeyer/8-12-2022

“Investors counting on a softer global economy to pull commodity prices lower may instead be faced with scare supplies and inflation, as the market is awash in contradictions, Goldman Sachs has warned clients.”

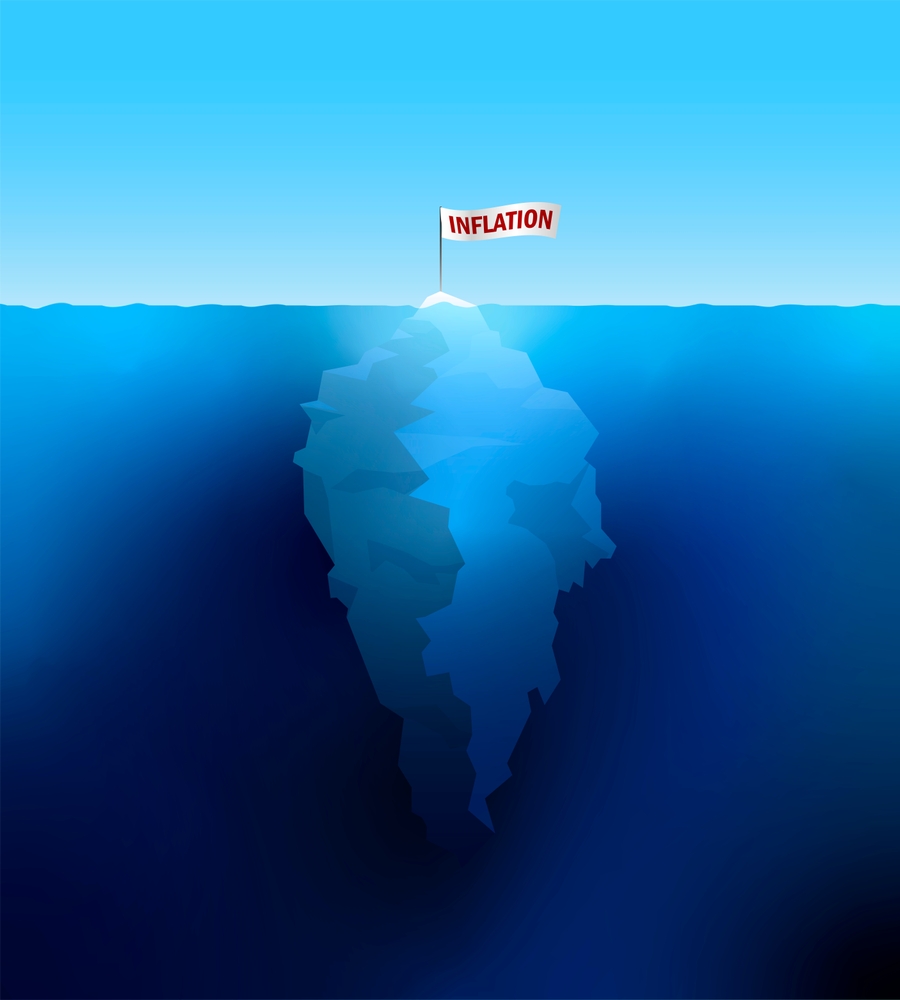

USAGOLD note: The latest from Jeffrey Curry, head of commodity research for Goldman Sachs …… He warns of the potential for commodity prices going “substantially higher” this fall if excess supply does not materialize as many have forecasted. Meanwhile, “of the major commodities, only corn and iron ore demand are expected to contract near term.” You get a sense from Currie that there is significantly more to the commodities question than meets the eye.