Yellen directs IRS to develop plan for $80B overhaul within 6 months

Former investment banker Carol Roth and former CKE Restaurants CEO Andy Puzder discuss Democrats’ strategy to combat rising inflation on ‘The Evening Edit.’

Treasury Secretary Janet Yellen on Wednesday asked the Internal Revenue Service to develop an operational plan for deploying the $80 billion in new funding allocated to it under the Democrats’ health care and climate change spending package.

In a memo addressed to IRS Commissioner Chuck Rettig, Yellen said the influx of funding over the next decade is a “significant operational challenge” that ultimately allows for a “monumental opportunity” to reshape the tax-collecting agency.

Yellen laid out her top priorities in the memo — a copy of which was obtained by FOX Business — which included clearing a backlog of unprocessed tax returns, modernizing IRS technology, improving taxpayer services and hiring “at least” 50,000 new employees over the next five years.

“The work will require an all-hands-on-deck approach from the dedicated employees of the IRS,” she wrote.

Yellen directed the agency to draft an operational plan within six months that includes details about how the money will be spent over the next decade, with specific operational initiatives and associated timelines.

STRATEGISTS, TAX EXPERTS WEIGH IMPLICATIONS OF MANCHIN-BACKED BILL ON MIDTERM ELECTIONS

President Biden smiles after signing into law H.R. 5376, the Inflation Reduction Act of 2022, in the State Dining Room of the White House on Tuesday, Aug. 16, 2022. (Demetrius Freeman/The Washington Post via Getty Images / Getty Images)

Providing the IRS with an influx of funding has been a top priority for Democrats and emerged as one of the most prominent financiers of the Inflation Reduction Act that President Biden signed into law this week. But it has elicited a fierce pushback from Republicans, who say that a beefed-up IRS could ultimately hurt lower-income Americans.

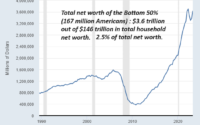

That’s because the IRS disproportionately targets low-income Americans when it conducts tax audits each year. In fact, households with less than $25,000 in earnings are five times as likely to be audited by the agency than everyone else, according to a recent analysis of tax data from fiscal year 2021 by the Transactional Records Access Clearinghouse (TRAC) at Syracuse University.

The reason for that is a rise in what is known as “correspondence audits,” meaning the IRS conducts reviews of tax returns via letters or phone calls rather than more complex face-to-face audits. Just a fraction — 100,000 of the 659,000 audits in 2021 — were conducted in person.

According to the Syracuse study, more than half of the correspondence audits initiated by the IRS last year — 54% — involved low-income workers with gross receipts of less than $25,000 who claimed the earned income tax credit, an anti-poverty measure.

The discrepancy is primarily due to high-income taxpayers having complex investments that can easily shroud the gaps between taxes owed and paid vs. taxes reported and paid.

Yellen has pushed back against that fear, reiterating in her memo that she directed the IRS to not increase audits on households earning less than $400,000 annually.

“These investments will not result in households earning $400,000 per year or less or small businesses seeing an increase in the chances that they are audited relative to historical levels,” Yellen wrote. “Instead, they will allow the IRS to work to end the two-tiered tax system, where most Americans pay what they owe, but those at the top of the distribution often do not.”

Treasury Secretary Janet Yellen testifies before the House Ways and Means Committee on Capitol Hill in Washington on June 8, 2022. (AP Photo/Jose Luis Magana, File / AP Newsroom)

The spending bill is expected to raise an estimated $739 billion over the next decade by increasing IRS funding, establishing a 15% minimum corporate tax targeting companies’ book income, allowing Medicare to negotiate prescription drug costs and imposing a 1% excise tax on corporate stock buybacks.

CLICK HERE TO READ MORE ON FOX BUSINESS

Revenue raised by the policies will go toward initiatives designed to combat climate change and curb pharmaceutical prices, as well as efforts to reduce the nation’s $30 trillion debt. It includes about $433 billion in new spending, while roughly $300 billion of the new revenue raised would go toward paying down the nation’s deficit.

[ad_2]

Source link