How Fed Tightening Of Rates, Not Balance Sheet, Impacts Mortgage Rates (NAHB Traffic Tanks In August) – Confounded Interest – Anthony B. Sanders

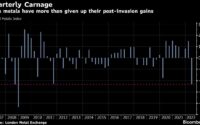

The US housing market is sensitive to Fed “catch-up” monetary tightening. For example, the NAHB’s traffic of prospective homebuyers declined rather dramatically in August as The Fed tightened rates and the 30yr mortgage rate rose. That is what I call a “Nestea Plunge.”

How are mortgage rates impacted by Fed monetary policy? While The Fed began really “sloshing” markets with excess stimulus (QE in late 2008), the latest round of QE (or asset purchases) came with the US Covid shutdowns (what genius thought of that??) and that stimulus has NOT been withdrawn yet. Only the Fed Funds Target rate has tightened.

The 30yr mortgage rate rose with Fed rate tightening, but the Fed’s System Open Market Holdings (SOMH) of Treasury Notes and Treasury Bonds has come down a bit. But not the pare-down The Fed has hinted at. The 30yr mortgage rate is cooling as the prospect of future Fed rate hikes declines.

As of this morning, The Fed Funds Futures market points to rates rising until March 2023 … then easing again.

One reason The Fed has been slow to sell assets off its balance sheet is that a large chunk of T-Notes and T-Bonds are maturing shortly. It will be a matter of whether The Fed reinvests the proceeds or lets the balance sheet wind-down.

[ad_2]

Source link