A prominent economist has begun to worry that Japan’s widening trade deficit could eliminate the last pillar of support for the world’s third-most widely used currency, potentially creating serious problems for its economy.

Carl Weinberg, founder and chief economist at High Frequency Economics, warned this week that Japan’s widening trade gap risked sparking a downward spiral in the yen that would be extremely out of character for a major world currency.

“We cannot put a point on it, but we fear Japan is headed toward a point not too far down the road where its yen comes into excess supply,” he wrote in a note to clients. “After all, what can one do with a bag full of yen?”

Hypothetically, a downward spiral of the yen could trigger a currency crisis like the 1997 Asian Financial Crisis, when the collapse of the Thai baht triggered a wave of currency devaluations, debt crises and foreign capital flight across East and Southeast Asia, although Weinberg didn’t go that far.

Historically, the yen has been strongly associated with the “risk off” or “safe haven” trade, a pattern that held for most of the decade-long bull run that followed the global financial crisis in 2008. Also, when the COVID pandemic triggered a historic selloff in global stocks, the yen rallied.

However, when global stock markets and other risk assets started cratering in the first half of 2022 as central banks started raising interest rates to combat inflation, yen strength was nowhere to be found. Instead, investors bid the U.S. dollar

DXY,

higher.

The dollar’s move against the yen this year already has been one for the history books. As of Wednesday, the dollar

USDJPY,

had risen more than 17% against the yen since Jan. 1 to trade at roughly 135 to the dollar. On July 14, the dollar briefly traded above 139 yen, its strongest level against the Japanese currency since 1998.

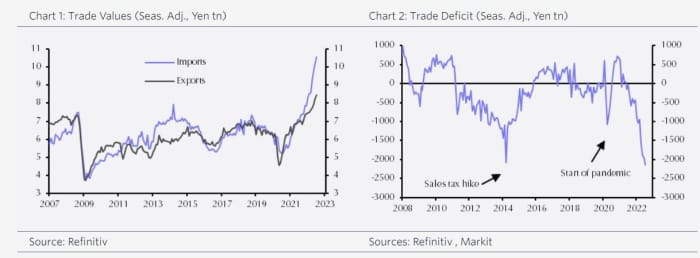

Weinberg’s focus on the Japanese trade deficit might seem outdated to some currency market observers, who have recently looked to other factors like real interest-rate differentials as the main force driving moves in currency pairs. But according to Weinberg, that could soon change now that Japan’s trade deficit has hit a record of 2.1 trillion yen, or $15.5 billion (see chart).

Source: Capital Economics

Real interest rates dictate the difference between the return that investors can receive by keeping their money invested in a given currency after inflation is factored in. Currencies that offer higher returns are typically more attractive to investors.

See: Yen plunges to weakest versus the buck since 1998, eyes 140

Weinberg’s fear is that Japan’s trade deficit could leave foreign investors holding more yen than they are willing to reinvest in Japanese government debt

TMBMKJP-10Y,

or stocks

NIK,

One reason for this, as Weinberg explains, is that the Bank of Japan has been adhering to a policy of yield curve control, which involves actively managing the yield on Japanese government bonds to keep them in a tight yield band near 0%.

The policy has been a double-edged sword. According to Weinberg, because the Bank of Japan has cornered the Japanese government bond market, keeping yields depressed, the country’s bonds are less attractive to foreign investors.

“No one wants yen as a store of value because JGBs pay negligible coupons,” Weinberg added.

Weinberg also worries about Japan’s demographic challenges, including a low birthrate and a rapidly aging population, which could begin to blunt the appeal of Japanese stocks for foreign buyers at a time when the Bank of Japan has been trying to extricate itself from its involvement in its domestic equity market. The Bank of Japan owns roughly half of outstanding Japanese government bonds, and more than 60% of domestic equity ETFs.

According to Mizuho, the Bank of Japan’s balance sheet has swelled to more than $9 trillion this year. So far, the yen remains an important player in global trade, with the International Monetary Fund pegging 6% of trade as invoiced in yen.

While Weinberg said the Bank of Japan has proven adept at managing its domestic bond and stock markets, managing a potential free fall of the yen could become far more tricky, especially if foreign investors no longer wish to dedicate as much space in their portfolios to Japanese assets, which could exacerbate downward pressure on the yen as holders look to sell currency they don’t plan to use for trade or investment.

A frequent guest on financial television networks like CNBC and Bloomberg Television, Weinberg is known as a pioneer in econometric forecasting, as well as for his advisory work with foreign governments during his stint as the senior international economist at Shearson Lehman Brothers, according to his biography on the High Frequency Economics website.