Fed seems to ‘draw a line in the sand’ on inflation, says JPMorgan, as danger of recession exceeds risk of inflation | Article_Normal

Fed seems to ‘draw a line in the sand’ on inflation, says JPMorgan, as danger of recession exceeds risk of inflation

While it is too early for the Federal Reserve to declare victory on inflation, there are good reasons to believe that it will continue to cool, according to…

According to David Kelly, chief global strategist at JPMorgan Asset Management, the July CPI report, which showed inflation dropping 0.6% from its June peak for… With central bankers heading to Jackson Hole, Wyo., this week for the Federal Reserve’s most important economic policy event of the year, officials have seemed to “draw a line in the sand” on inflation, as there are reasons to believe that four-decade-high inflation will continue to cool while recession risks are rising, a JPMorgan strategist said in a note Monday.

Read more: MarketWatch »

Supporters gather at home of Pakistan’s former PM Khan, aiming to foil arrest

Hundreds of supporters of Pakistan’s former prime minister, Imran Khan, gathered on Monday outside his hilltop mansion in the capital, vowing to prevent his arrest on anti-terrorism accusations, officials of his political party said. Read more >>

Business economists give soft landing the side-eyeA new survey offers a bit of insight into the way the Fed’s actions can affect the psychology of people who help make decisions in corporate America. as they should. a soft landing is a fantasy dreamed up by politicians who can’t admit they juiced the economy until it couldn’t be stimulated any more and the crash is not only inevitable but more severe than if they had taken steps earlier.

Houston Newsmakers: Inflation reduction act may not help inflation, research saysIf you missed today’s episode of Houston Newsmakers, catch up here. 👇 You can also catch a rerun Monday at 12:30 p.m. at KPRC 2+

Inflation: The Fed’s hawkish stance risks ‘overkill,’ economist saysInflation currently sits at 8.5%, which is a decrease from June’s 40-year high of 9.1%. The Fed has stated that its goal is to reduce inflation levels down to 2% by 2024 through rapid interest rate hikes. But King Biden said it was zero. Yea but officer, I know I was doing 115mph but when you caught me I was only doing 113

U.K. inflation could surge to 19% by next year, Citi economist saysJust as consumers are getting used to double-digit inflation, a new forecast says U.K. inflation could reach 18.6% early next year. Global inflation, economic crisis, stock market falls, the economic crisis will inevitably bring about a wave of unemployment, and it is not appropriate to change jobs now.

For Republican governors, all economic success is localTexas Gov. Greg Abbott often knocks President Biden for the country’s high rate of inflation and fears of a looming recession. What economic success? Look at all the shine gives DeSantis. Over here in Compton we don’t give two fux what that Bozo has to say. About anything. Democratic governors do not know the meaning of success. So we’re even…

Texas, Georgia, Florida leaders blame inflation on Biden, but it’s worse in their statesWASHINGTON — Gov. Greg Abbott, R-Texas, often knocks President Joe Biden for high inflation and a looming recession — a standard GOP… Well, this headline is a bit misleading – article clearly states disproportionately high inflation in CityOfDallas , Houston, Atlanta, and Miami have lifted the overall inflation for those states. The article then explains how much better red states are economically. True. I live in DFW . Rent is high as hell . My granddaughter pays 1500 a month for a 1 bedroom. There’s no rent control law here and the wages are LOW & car insurance HIGH. Home prices HIGH, Property taxes HIGH,

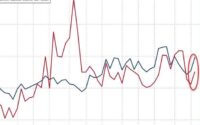

With central bankers heading to Jackson Hole, Wyo.Axios on email Data: NABE; Chart: Nicki Camberg/Axios A new survey shows business economists are skeptical the Fed can bring inflation down to its target without sinking the economy.Inflation impacts and how much the American public is being hurt (KPRC/Pixabay) Democrats have been touting last week’s passing of the “Inflation Reduction Act” as a big win for President Biden.currently sits at 8.

, this week for the Federal Reserve’s most important economic policy event of the year, officials have seemed to “draw a line in the sand” on inflation, as there are reasons to believe that four-decade-high inflation will continue to cool while recession risks are rising, a JPMorgan strategist said in a note Monday. According to David Kelly, chief global strategist at JPMorgan Asset Management, the July CPI report, which showed inflation dropping 0. Driving the news: The numbers, published on Monday morning, are from the National Association of Business Economists — a group of people who work largely for private-sector companies, rather than academia.6% from its June peak for. Those would reduce the price of certain goods and would help people in terms of their budgets,” said John Diamond, Ph.. The impact: If private-sector economists are advising executives that a recession is likely around the corner, that could create something of a self-fulfilling prophecy — as executives delay new projects and investment, both of which make a recession more likely to come to pass..”And talking about 50 basis points in November, I think it’ll be 25.

With central bankers heading to Jackson Hole, Wyo. “But it doesn’t reduce inflation over the long term., this week for the Federal Reserve’s most important economic policy event of the year, officials have seemed to “draw a line in the sand” on inflation, as there are reasons to believe that four-decade-high inflation will continue to cool while recession risks are rising, a JPMorgan strategist said in a note Monday. According to David Kelly, chief global strategist at JPMorgan Asset Management, the July CPI report, which showed inflation dropping 0.6% from its June peak for a year-over-year rate of 8.” Ad New President touts new opportunities at TSU Lesia Crumpton-Young, Ph.5%, offered some hope that inflation is cooling down. You’ll remember the word ‘overkill’ — you might hear that word again.

Meanwhile, the outlook for August CPI also “looks good,” with a very steady continued decline in gasoline prices, airline fares, hotel rates and used-vehicle prices, which might be enough to generate a second consecutive mild CPI report ahead of the central bank’s policy meeting in September, noted Kelly. See: Fed Jackson Hole preview: Powell to stress a recession won’t stop Fed’s fight against high inflation However, the minutes of the July FOMC meeting showed that Fed officials agreed that it was necessary to move their benchmark interest rate high enough to slow the economy to combat high inflation and then bring it back down to its 2% target. Now entering her second full year at the helm, she is a guest on this week’s Houston Newsmakers and says being president is a calling, not a career move and that she is ready to lead the way. But according to JPMorgan, the danger of recession has already exceeded the risk of inflation, and staying at current levels could inflict long-term economic damage. “If the Fed recognizes this in the next few weeks, they will moderate the pace of monetary tightening, potentially giving a further boost to U.S. “The reason we created that is to serve individuals who went to school, who took courses and they have relevant work experience but for some reason they were not able to complete their degree,” she said. Federal Reserve Chair Jerome Powell takes questions from reporters in Washington, D.

bond and stock markets,” Kelly said in Monday’s client note. “If they do not, then interest rates could be higher in the short run but probably lower next year. The ultimate destination is likely the same either way — a slow-growing economy with moderate inflation and interest rates. right after Meet the Press.” “However, the more volatile economic and market cycle that could be unleashed by an overly aggressive Federal Reserve could lead to a further near-term reassessment of valuations that would likely favor value over growth, and, by ultimately sinking the U.S. So we’re going to have soft economic numbers.

dollar, favor international over U.D.S. equities,” according to Kelly. See: Beware of a ‘bear trap’ retreat in stocks after the big summer rally, strategists warn U.S.

stocks on Monday recorded the worst trading day in two months as investors worried the Federal Reserve may not pivot away from sharply higher interest rates to fight inflation. The S&P 500 SPX fell 90.49 points, or 2.1%, to finish at 4,137.99.

The Dow Jones Industrial Average DJIA was down 643.13, or 1.9%, to 33,063.61, while the Nasdaq Composite COMP declined 323.64, or 2.

6%, ending at 12,381.57. Yields on 10-year Treasury notes TMUBMUSD10Y climbed to 3.035% on Monday to their highest level since July 20, as investors awaited an update from Federal Reserve Chairman Jerome Powell, who is expected to deliver a highly anticipated speech on the economic outlook later in the week. The yield on the 2-year Treasury TMUBMUSD02Y rose to 3.

335%, its highest since June 14. Yields move in the opposite direction of prices. .

[ad_2]

Source link