US Treasury Yields And Mortgage Rates Rise As Fed Vows To Extinguish Inflation Fire (Caused By Themselves And BAD Federal Policies) Check Out The Eurozone – Confounded Interest – Anthony B. Sanders

August 30, 2022

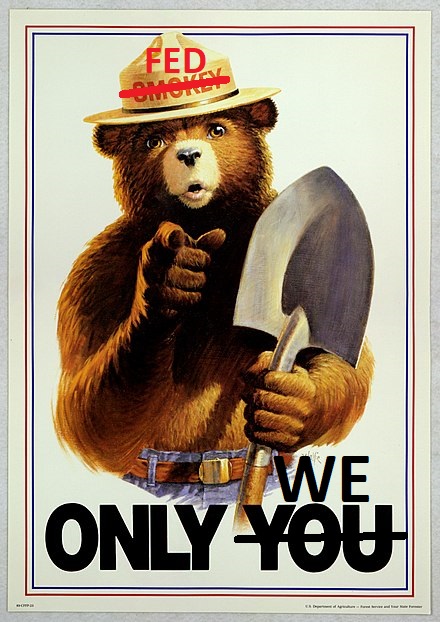

As inflation burns the US middle class and low wage workers, The Federal Reserve reaffirmed at Jackson Hole that they are the NEW Smoky The Bear (only The Fed can fight inflation fire!) But of course, Federal spending and energy policies can drive up prices too.

Having said that, the 2-year Treasury yield and 30yr mortgage rate are rising rapidly.

The Fed is trying to cool demand by raising rates after lax monetary policy since late 2008.

While the US 2-year Treasury yield is up only slightly today, the Eurozone is seeing their 2-year sovereign yields spiking by 11-15+%.

[ad_2]

Source link