August Payrolls Drop To 315K, Above Expectations; But Unemployment Rate, Earnings Both Miss

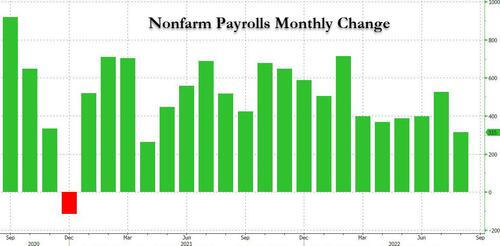

With Goldman warning ahead of today’s payrolls print that an “Inline print of 300k(ish) will keep pressure on this tape”, moments ago the BLS reported that – as expected in the somewhat negative case – August payrolls indeed came 300k(ish)- or 315K specifically, dropping from an downward revised 528K in July, and just above the 298K consensus estimate. After all of last year’s data revisions, this was the lowest monthly increase since April 2021.

Nonfarm employment has risen by 5.8 million over the past 12 months, as the labor market continued to recover from the job losses of the pandemic-induced recession. This growth brings total nonfarm employment 240,000 higher than its pre-pandemic level in February 2020.

Also of note is that the change in total nonfarm payroll employment for June was revised sharply lower by 105,000, from +398,000 to +293,000, and the change for July was revised down by 2,000, from +528,000 to +526,000. With these revisions, employment in June and July combined is 107,000 lower than previously reported.

In any case, with the headline rate coming in on top of Goldman’s negative bogey, why are futures surging premarket? Two reasons:

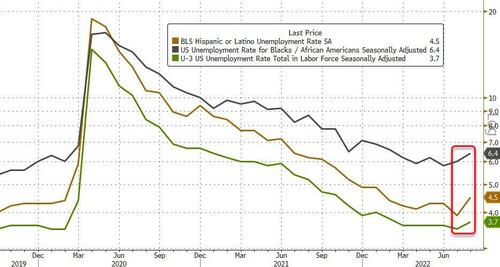

First, the unemployment rate came in well above expected, printing at 3.7%, missing expectations of 3.5%, and above last month’s 3.5% print as the number of unemployed persons increased by 344,000 to 6.0 million, while the number of people employed rose by 442K as the labor force jumped by 800,000 people (that’s 800K Americans who returned to the labor force). The unemployment rate ticked up as the labor market wasn’t able to fully absorb the swell of entrants.

Among the major worker groups, the unemployment rates for adult men (3.5 percent) and Hispanics (4.5 percent) rose in August. The jobless rates for adult women (3.3 percent), teenagers (10.4 percent), Whites (3.2 percent), Blacks (6.4 percent), and Asians (2.8 percent) showed little change over the month.

Another reason for the rise in the unemployment rate: the participation rate rose more than expected, printing 62.4% in August, above the 62.2% expected, and up from 62.1% last month.

The second reason for the spike in futures is because hourly earnings slowed again, and rose 0.3% in August, below the 0.4% expected and down notably from July’s upward revised 0.5%. On an annual basis, average hourly earnings rose 5.2%, also below the 5.3% expected.

Some more details:

- In August, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3 percent, to $32.36. Over the past 12 months, average hourly earnings have increased by 5.2 percent. In August, average hourly earnings of private-sector production and nonsupervisory employees rose by 10 cents, or 0.4 percent, to $27.68.

- The average workweek for all employees on private nonfarm payrolls decreased by 0.1 hour to 34.5 hours in August. In manufacturing, the average workweek for all employees was little changed at 40.3 hours, and overtime held at 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls declined by 0.1 hour to 33.9 hours.

In other words, solid headline payrolls number, but weakness in the unemployment rate and another much needed tapering in wage growth. Still, it’s hard to see this report taking a 75-basis-point Fed hike off the table for Sept. 21. As such, the CPI report out on Sept. 13 will likely be the decider when it comes to 50 vs 75.

Some other details on the aftermath of the covid lockdowns:

- The number of Americans working from home because of the pandemic declined again in the month to 6.5% from 7.1%.

- In August, 1.9 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic–that is, they did not work at all or worked fewer hours at some point in the 4 weeks preceding the survey due to the pandemic. This measure is down from 2.2 million in the previous month.

- Among those not in the labor force in August, 523,000 persons were prevented from looking for work due to the pandemic, little changed from the prior month.

And some bigger picture details:

- The number of persons employed part time for economic reasons was little changed at 4.1 million in August. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full- time jobs.

- The number of persons not in the labor force who currently want a job declined by 361,000 to 5.5 million in August. This measure remains above its February 2020 level of 5.0 million. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force, at 1.4 million, was little changed in August. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. Discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, numbered 366,000 in August, little changed from the prior month.

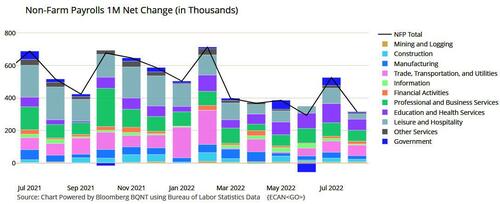

Next, this is the breakdown of jobs by sector: In August, notable job gains occurred in professional and business services, health care, and retail trade.

- Professional and business services added 68,000 jobs in August. Within the industry, employment gains occurred in computer systems design and related services (+14,000), management and technical consulting services (+13,000), architectural and engineering services (+10,000), and scientific research and development services (+6,000), while legal services lost jobs (-9,000). Over the past 12 months, professional and business services has added 1.1 million jobs.

- Health care employment rose by 48,000, with job gains in offices of physicians (+15,000), hospitals (+15,000), and nursing and residential care facilities (+12,000). Health care has added 412,000 jobs over the year. Despite this growth, employment in health care is below its February 2020 level by 37,000, or 0.2 percent.

- Retail trade added 44,000 jobs in August and 422,000 jobs over the past 12 months. In August, employment increased in general merchandise stores (+15,000), food and beverage stores (+15,000), health and personal care stores (+10,000), and building material and garden supply stores (+7,000). Employment in furniture and home furnishings stores continued to trend down (-3,000).

- Manufacturing employment continued to trend up in August (+22,000), with gains concentrated in durable goods industries (+19,000). Manufacturing has added 461,000 jobs over the year.

- Employment in financial activities rose by 17,000 in August and by 200,000 over the year.

- Employment in wholesale trade increased by 15,000 in August, returning to its February 2020 level. This industry has added 197,000 jobs over the year.

- Mining employment rose by 6,000 in August, reflecting a gain in support activities for mining (+7,000). Over the year, mining has added 68,000 jobs.

- Employment in leisure and hospitality changed little in August (+31,000), following average monthly gains of 90,000 in the first 7 months of the year. Employment in leisure and hospitality is below its February 2020 level by 1.2 million, or 7.2 percent.

- In August, employment showed little change in other major industries, including construction, transportation and warehousing, information, other services, and government.

And visually:

Commenting on the report, Dennis DeBusschere, founder of 22V Research said that “this is positive for risk assets on the day as it reduces the odds that the Fed has to push rate hike expectations even higher. That being said, chasing the market is tough as demand appears to strong still for the Fed. So they are unlikely to let financial conditions ease much. That limits the upside on this number. Keep in mind the number is still pretty strong.”

John Kolovos, chief technical strategist at Macro Risk Advisors, had this to say on the markets reaction: “Whether you are in the prolonged bear market camp of lower lows or not, the tape was sufficiently oversold for a sharp recovery. With Payrolls slightly above forecast, the Unemployment rate higher, and the average hourly earnings a bit weaker, the market’s initial reaction higher confirms that sentiment was too bearish heading into he print and that recovery to 4,055 is building but with the scope to reach 4,220 on the S&P 500.”

Finally, John McClain, portfolio manager at Brandywine Global, said investors shouldn’t read too much into just one number, but this is yet another data set that shows the Fed has its work cut out: “The Fed should be locked into continued fast and furious restrictive policy. While the Unemployment Rate rose on downward revisions and Labor Force Participation ticked up, this isn’t Goldilocks. A strong rally in risk assets will lead to the same loosening financial conditions the Fed just said they weren’t pleased with.”

“Investors shouldn’t overreact to today’s price movement’s with skeleton crews working at banks on a summer Friday pre-Labor Day. We expect elevated volatility over the coming weeks as the market fully embraces the fact that the Fed has taken the training wheels off the market.”

[ad_2]

Source link