US Dollar Index treads water around 109.60 ahead of data

- The index alternates gains with losses around 109.60.

- US markets return to the normal activity after Monday’s holiday.

- US ISM Non-Manufacturing, Final Services PMI next on tap.

The greenback, in terms of the US Dollar Index (DXY), trades near to Monday’s close around the 109.60 region.

US Dollar Index focuses on data

The index navigates within a tight range around 109.60, as US markets slowly regain the normal activity following Monday’s Labor Day holiday.

In fact, the dollar keeps the trade in the upper end of the recent range and comes under some mild pressure following Monday’s new cycle highs past the 110.00 hurdle.

No changes to the main drivers behind the price action in the index, as investors continue to closely follow messages from Fed’s policy makers ahead of the key September meeting, where the central bank is so far expected to raise rates by 75 bps.

Later in the session, the US services sector will take centre stage in light of the release of the final S&P Global Services PMI and the ISM Non-Manufacturing, both readings for the month of August.

What to look for around USD

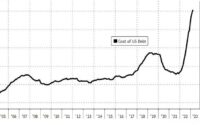

The index keeps the bullish outlook well in place despite coming under some pressure after hitting fresh peaks above 110.00, an area last seen nearly 20 year ago.

Bolstering the dollar’s strength appears the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market. This view was reinforced by Chair Powell’s speech at the Jackson Hole Symposium.

Extra volatility in the dollar, however, should not be ruled out considering the ongoing debate around the size of the September’s interest rate hike by the Federal Reserve amidst the ongoing data-dependent stance in the Fed.

Looking at the more macro scenario, the greenback appears propped up by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: ISM Non-Manufacturing, Final Services PMI (Tuesday) – MBA Mortgage Applications, Balance of Trade, Fed Beige Book (Wednesday) – Initial Claims, Consumer Credit Change, Fed Powell (Thursday) – Wholesale Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation over a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

US Dollar Index relevant levels

Now, the index is advancing 0.03% at 109.63 and a break above 110.27 (2022 high September 5) would aim for 111.90 (weekly high September 6 2002) and then 113.35 (weekly high May 24 2002). On the other hand, the next contention turns up at 107.58 (weekly low August 26) seconded by 106.88 (55-day SMA) and then 104.63 (monthly low August 10).

[ad_2]

Source link