Behind The Curve! US Headline Inflation 8.5% Is Far Ahead Of Fed Target Rate 2.5% (Eurozone Is In Similar Situation 9.1% Inflation Versus 0.75% Deposit Rate) – Confounded Interest – Anthony B. Sanders

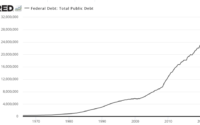

The Federal government reaction to the Covid outbreak in early 2020 included massive monetary stimulus, Federal government spendathons and Biden’s green energy policies have resulted in a sizzling 8.5% inflation rate (update on Monday morning).

The problem is that The Federal Reserve is far behind the inflation curve with their target rate at only 2.5%. And The Fed’s balance sheet remains near $9 TRILLION in assets held.

In Euroland, we are seeing a similar problem (Frankfurt, we have a problem!). The Eurozone inflation rate is at 9.1% while their version of The Fed Funds Target rate is only 0.75%, a large catch-up gap.

If we look at the Taylor Rule for the US using headline inflation, we see that The Fed needs to raise their target rate to … 21.72% to crush inflation.

In Euroland, the problem is similar. At 9.10% inflation, the ECB will have to raise their version of The Fed’s target rate to 16.80% to combat inflation. As if that will happen in either the US or Euroland.

On a different note, is it my imagination or does US Democrat Senate candidate from Pennsylvania John Fetterman look like the alien from the flick “Battleship”?

Fetterman is the top picture.

Here is a video of the Fetterman/Dr. Oz debate … if it ever occurs.

[ad_2]

Source link