The CPI Is Not Cooling and That’s a Big Problem for the Fed

The August Consumer Price Index surprised to the upside, ramping up expectations for another aggressive Federal Reserve rate hike. It also reveals a big problem for the Fed that most people haven’t come to grips with yet.

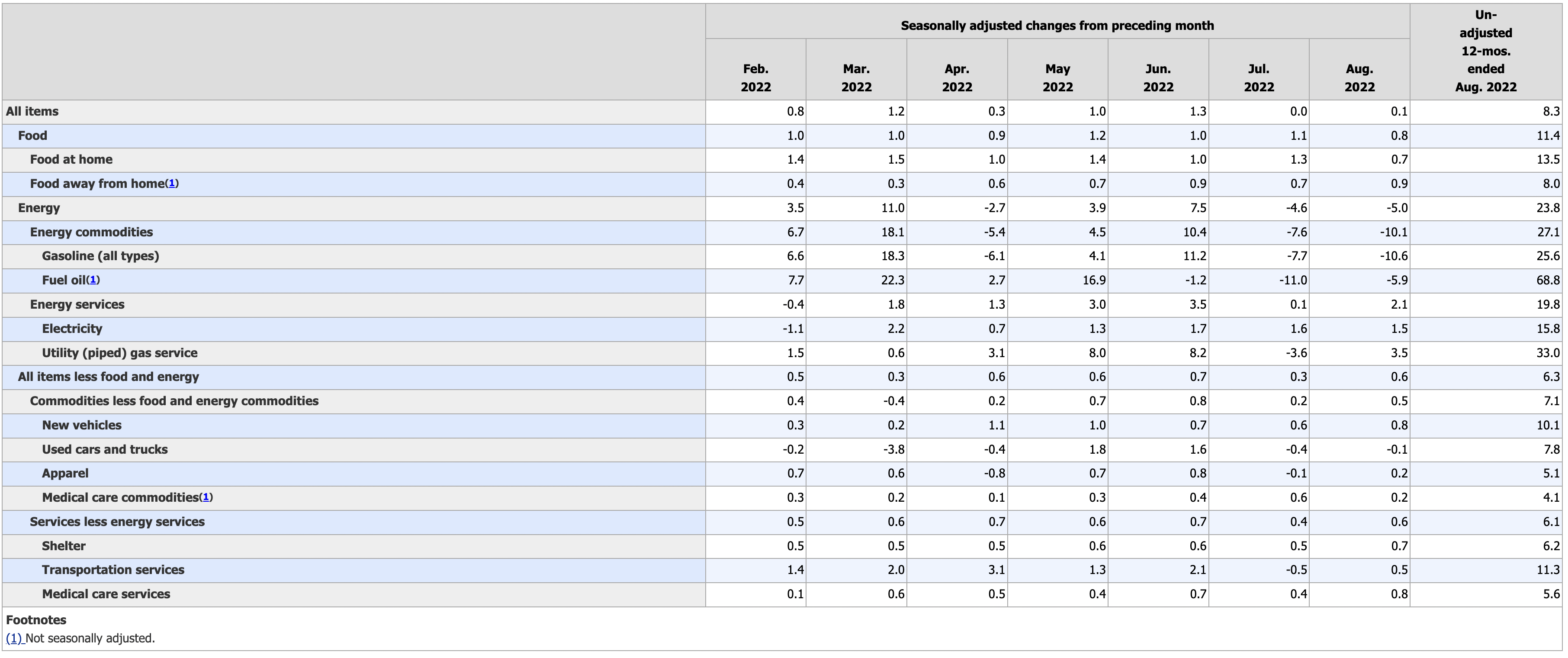

The headline annual CPI number did cool a bit falling to 8.3% from 8.5% in July. But month-on-month, CPI rose 0.1% despite another big drop in energy prices.

Core CPI, excluding food and energy prices, came in at 0.6% month-on-month. On an annual basis, core CPI rose 6.3%. That was up from a 5.9% annual increase in both June and July.

The bottom line is inflation clearly hasn’t cooled significantly, despite falling energy prices.

Projections were for headline inflation to fall 0.1% and core to increase 0.3%.

And as I mention every time I talk about CPI, it’s even worse than these numbers suggest. This CPI uses a government formula that understates the actual rise in prices. Based on the CPI formula used in the 1970s, CPI remains in the 17% range — a historically high number.

Energy prices fell 5% during August. The gasoline index plunged by 10.6%, but that wasn’t enough to offset price increases in other categories.

The only non-energy category to chart a price decline in August was used vehicles. Meanwhile, food prices rose another 0.9% during the month. Shelter costs were up 0.7%.

The markets responded to the higher-than-expected CPI with a vengeance. The Dow Jones fell by over 1,276 points. It was the seventh-biggest drop (based on points) in history. Other stock market indices charted similar declines. The NASDAQ fell 5.16%.

Stocks fell in anticipation of even more aggressive action by the Federal Reserve. The markets have now priced in a 100% chance of a 75-basis point rate hike at the September FOMC meeting next week and a 24% chance of a full one-percent hike.

Economist Peter St. Onge pointed out that this big stock market crash was the result of just a one-quarter point upward adjustment to the interest rate expectation a year from now.

Meaning if we do go full Volcker, we ain’t seen nuthin’ yet.”

St. Onge is referring to former Federal Reserve Chairman Paul Volker who took interest rates to 20% in order to slay the inflation of the 1970s and early 80s. Despite all of the tough talk, Jerome Powell is no Paul Volker, and there is no indication the central bank has the fortitude to push interest rates above the CPI.

The numbers indicate that Fed can’t win this inflation fight. If you look at all of the Fed tightening cycles since 1973, the central bank has never stopped tightening before the Fed funds rate was higher than the CPI. We have a long way to go to get to that level. Meanwhile, the economy is already shaky and we’re seeing big stock market selloffs.

After denying the inflation problem for months, calling it “transitory,” the Fed started aggressively (by Fed standards) fighting inflation earlier this year. Over the last several months, the central bank has pushed interest rates from zero to 2.5%. But as Peter Schiff pointed out during an interview on the Claman Countdown, these rate hikes aren’t enough to slay inflation growing at an 8.3% rate annually.

The Fed actually falls further behind the inflation curve every time it hikes rates because these rate hikes are too little too late. The Fed needs to make interest rates positive to do anything to bend the curve. They have to get rates above the rate of inflation. And until they do that, they’re spitting in the wind.”

The August CPI hints at a dirty little secret the mainstream has yet to come to grips with: the central bank can’t pump trillions of dollars into the economy and then expect to undo the damage with a few little rate hikes.

Starting with quantitative easing in the wake of the 2008 financial crisis and then quadrupling down during the pandemic, the Federal Reserve blew up massive bubbles. The Fed can’t take all of that easy money away without popping those bubbles.

In a series of tweets, Peter Schiff outlined exactly what it would take to slay the inflation monster.

The Fed can return to 2% inflation if it does all of the following:

- Crash the stock, bond, and real estate markets.

- Allow a severe recession with no stimulus.

- Allow a worse financial crisis than 2008.

- Allow big banks to fail without bailing any out, including letting customers lose their deposits.

- Force the federal government to slash spending, including making deep cuts to Social Security and Medicare.

- Force the US Treasury to default and restructure the national debt, with holders of Treasuries taking significant haircuts.

The Fed can keep pretending to fight inflation for a while. In the same way that the central bankers denied inflation was a problem for months, they can continue to tell you the economy is strong and everything is fine. But at some point, the carnage will become too obvious to deny.

The question is then what?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

[ad_2]

Source link