Bloomberg/Staff/9-18-2022

“Funds are already fleeing gold. Hedge funds and money managers have turned net bearish on the precious metal. Some traders reckon there’s worse to come for gold until Fed language on inflation moderates, although others point to residual support for prices from heightened geopolitical and economic risks.”

USAGOLD note 1: In this largely unsettled investment environment, influenced greatly by what we would describe as neolithic algo-based trading systems, It would be a mistake in our view to draw quick conclusions. The jury is still out on how the investment community will adjust to the current inflation trend. Keep in mind it has not even been a year since Wall Street fully embraced Fed reassurances that inflation was transitory. For better or worse, it still clings to that notion when it is more and more looking like a case of entrenched case of wishful thinking. In fact, there is a growing perception that headline inflation could rise above the 9.1% high in June of this year. (See post below.)

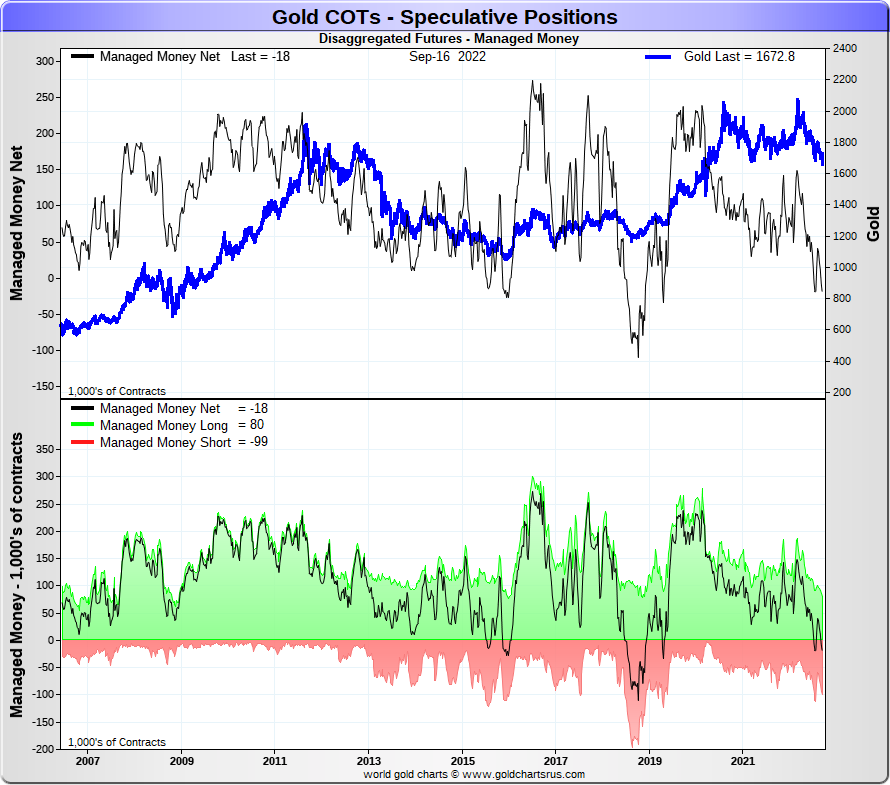

USAGOLD note 2: Bloomberg uses reduced managed money Commitment of Traders’ positions as proof of its thesis that gold might not be the place to be as a hedge against future inflation. Such logic might be a case of trying to make the data fit the presumption rather than the other way around. First, the COT positions ignore the solid ongoing demand for physical gold on a global basis – a reflection of general concern about inflation and the public’s perception of the metal as a hedge. Second, managed money gold positions have always been viewed as a contrary indicator. If you look closely at the extended chart posted below, you can see that when managed money positions dipped near or below the zero line (most notably in 2006, 2015, and 2018 it was a precursor to quick reversal and much higher prices.

Chart courtesy of GoldChartsRUs/Nick Laird

Chart courtesy of GoldChartsRUs/Nick Laird