Powell Scrapped His Original Jackson Hole Speech Just To Crush Stocks

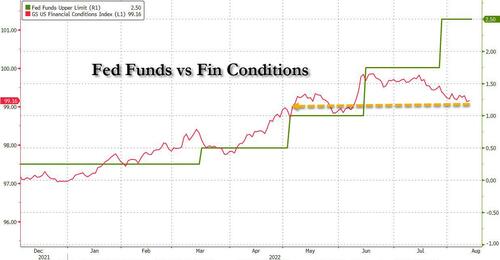

A little over a month ago we warned that even prominent traders on Goldman’ flow desk were concerned by the market’s extremely dovish take of Powell’s July FOMC “pivot”, which had sent stocks soaring and financial conditions easing back to extreme(ly easy) levels, in effect undoing much of the central bank’ tightening cycle.

Understandably, it was around then that Goldman trader Matt Fleury asked “did Powell really mean to be so dovish?” noting that with inflation still just shy of double digits, “”has the Fed chair truly pivoted and is he now putting risk assets back at the top of the Fed wall of worry?”

Of course, following the Jackson Hole symposium, in which Powell’s brief 8-minute speech crushed the latest bear market rally, we knew the answer.

“I suspect Powell wasn’t happy that things eased after the July meeting,” William English, a former senior Fed economist who is now a professor at the Yale School of Management, told the WSJ. And today, just to telegraph how much of a “no” it really was, and how much the Fed hates upticks in the stock market, Powell’s favorite WSJ mouthpiece, Nick Timiraos writes that at the time Goldman was wondering if the Fed chair “meant to be so dovish,” Fed officials were similarly concerned that investors were misreading their intentions given the need to slow the economy to combat high inflation. The punchline: according to Hilsenrath, in his widely anticipated J-Hole speech, “Powell decided to be blunt. He scrapped his original address, according to two people who spoke to him, and instead delivered unusually brief remarks with a simple message—the Fed would accept a recession as the price of fighting inflation.“

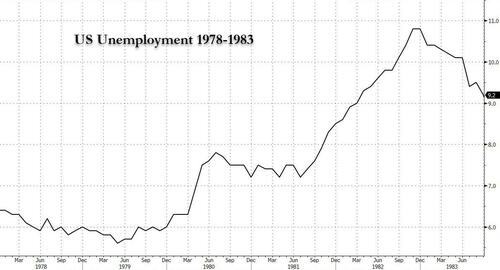

Confirming what many sensed at the time, Timiraos writes that Powell’s repeated references to former Fed chairman Paul Volcker, who nuked the economy in the early 1980s with punishing rate increases to break the back of double-digit price gains, was no accident. “We must keep at it until the job is done,” Mr. Powell said, invoking the title of Mr. Volcker’s 2018 autobiography, “Keeping At It.”

Of course, it wasn’t the market’s fault for initially misreading the utterly clueless Fed chair, who just one year ago was championing an aggressive stimulus campaign predicting not rates hikes for years; fast forward to today when the Fed has repeatedly admitted it was dead wrong about “transitory inflation” (just as we predicted at the time) and this year has unleashed the most rapid tightening of monetary policy… since Volcker.

“Until inflation comes down a lot, the Fed is really a single mandate central bank,” said Richard Clarida, who served as Mr. Powell’s second-in-command from 2018 until this past January.

Without explicitly predicting a recession, officials have made clear their willingness to tolerate one. Mr. Powell has stopped talking about a so-called soft landing, in which the Fed slows growth enough to bring down inflation without causing a recession, except when asked. Instead, he has framed the Fed’s objective of bringing down high prices as an “unconditional” obligation and warned of even worse consequences for employment later if the Fed does not defeat inflation now. “We can’t fail on this,” Mr. Powell told lawmakers this summer.

* * *

Mr. Powell lauds Mr. Volcker’s legacy not because of the precise tactics he used, but because “he had the courage to do what he thought was the right thing,” he said this spring at a news conference. “If you read his last autobiography, that really comes through.”

There’s more in the full WSJ article, but we get the gist of it: we now have confirmation that Powell – after being dead wrong in 2020-2021 and easing far too long and enabling helicopter money and the idiocy that is MMT – wants to pivot 180 and become this generation’s Volcker, even if it means a recession. There is just one problem: the Fed thinks it can contain the fallout, just like in 2020/2021 (and every year before that) it will be wrong about everything. In fact, keep an eye on Wednesday’s FOMC economic projections: we are confident that even after indicating that it wants a recession, the Fed will still not forecast a recession, i.e., it will anticipate an “smooth landing” for the economy. Here’ what will actually happen, now that the former lawyer and PE millionaire wants to play Volcker:

That’ right, unemployment doubling to 11%, just as it did in the early 1980s, with a crushing recession raging and the economy in the toilet… just as China invades Taiwan.

We can only hope that Biden and outspoken populist Democrats such as Liz Warren have a convenient scapegoat like Putin in the next 12-18 months to explain away the worst US recession in 4 decades (one which easily eclipses the global financial crisis, as China won’t be bailing out the US or the world this time).

hacked? https://t.co/wl79sgvFSI

— zerohedge (@zerohedge) September 9, 2022

What will happen then when millions of newly unemployment Americans suddenly realize that contrary to Biden’s drivel, this is not the greatest economy in recent history? Why a furious barrage of demands from democrats urging Powell to cut as fast as possible to zero, if not negative, and do another multi-trillion QE. We can only hope the market isn’t too broken (by the Fed, of course) to be able to anticipate what so obviously comes next.

[ad_2]

Source link