The Core! US 30y Mortgage Rate Rises (US Futures Fall as Traders Eye Supersized Fed Hike) – Confounded Interest – Anthony B. Sanders

Even Obama’s economic advisor, Larry Summers, is wondering why Biden won’t allow pipelines to be build to reduce energy prices and reduce inflation.

Having said that, US mortgage rates are now the highest since 2008 and continue to rise with the expectation of more Fed rate hikes this year. Even core inflation is on the rise motivating The Fed to do more tightening since they aren’t receiving any help from Biden on energy or Congress in terms of massive spending of our money.

Mortgage payments for a median existing home in the US is back to the mid-1980s.

Data from Fed Funds futures implies that The Fed will raise their target rate to 4.50% by March 2023, then slowly lower rates.

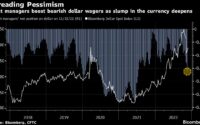

Futures are down with the prospect of a 75 basis point bump in rates tomorrow. The Dow Jone Mini is down -167 points.

[ad_2]

Source link