Core Inflation Accelerates Despite What Zoltan Said

Good Morning. The dollar is up 53. Bonds are slightly stronger. Stocks are strong, up between 40 and 75 bps. Gold is up $9 after touching up $13. Silver is up 29 cents. Crude is unchanged. Natural Gas is also unchanged after being significantly stronger earlier. Crypto is up about 1.2%. Grains are soft. ZeroHedge’s Fed prep is here

Summary of Goldman’s Report

Authored by GoldFixSubstack

- Expect the FOMC to deliver a third 75bp rate taking the funds rate to 3-3.25%.

- Expect 50bp hikes in November and December, taking the funds rate to 4-4.25% at year end.

- Services inflation will likely remain high, but we expect the FOMC to slow the pace of rate hikes because…concern about over-tightening will eventually rise, and the drop in consumer inflation expectations should reduce concerns.

The thing that hit us wrong was “services inflation will likely remain high”. That should not be the case at all. It reminded us of this (our emphasis):

Maybe the path to slower services inflation – OER and all other services – is through lower asset prices. – Zoltan Pozsar

Beyond their 75 bp hike we are not so sanguine about the FOMC path . Here’s why.

Inflation may be headed lower, but how it is lower is the problem and betrays the Fed’s lack of effectiveness in handling this emerging crisis.

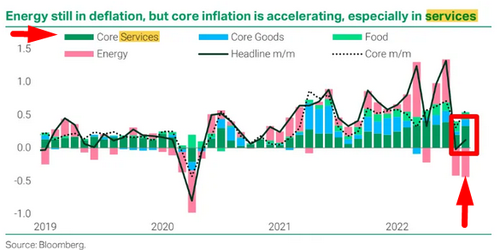

Core has not backed off. Inflation is down because of dwindling bullish energy speculation and SPR draws only— not because of domestic services inflation backing off. All we really need to get inflation back on the upward path is a spike in oil. Energy market success is masking the real problem here in a big way. The problem is services-inflation is actually accelerating.

The Fed’s actions were supposed to stop services-inflation first. Remember: The Fed had previously admitted they cannot stop imported goods supply-side inflation. They claimed they will be better at controlling domestically generated service side inflation. Which makes perfect sense considering the US makes little of what goods it consumes. Why re no banks questioning the service goods inflation yet? Especially when this was the gut rationale of the Fed inflation-fighting thesis.

Zoltan Pozsar said as much back in February and again in April. From: Cure Inflation “By Forcing Long Term Rates Higher”- Zoltan Pozsar

They [The FOMC] understand that they have no control over goods prices unless they curb demand through a recession – which given their updated mandate isn’t an option. But they also know that they have a lot of control over services inflation… SOURCE

This is a key component and rationale for the Fed’s actions thus far. Control services inflation easier by decreasing domestic demand via rate hikes. Supply side inflation will have to take care of itself ultimately as they cannot print goods. Yet services inflation increases even while shares drop. This suggests more tightening now, and more easing after the crash that it causes.

Fed Rate Hikes have No Effect on services inflation yet…

Source/ TSLombard. Edits GoldFix

As TS Lombard noted this week: “But the fact that core services inflation remains high shows just how tight the US labor market remains. It will take more time, more tightening and more labor market slack –even a recession –to bring it down.“

They are being kind. They mean a bigger recession.

Zoltan continued in April:

Maybe the path to slower services inflation – OER and all other services – is through lower asset prices. – Source

The Fed believed that decreasing the wealth effect by getting assets lower, as noted above, then services inflation would back off giving them some breathing room to cope with goods inflation. We did get lower asset prices. We have not however gotten lower service costs.

If the Fed fails to quell Service inflation, it will not be able to address the wage price increases that must follow. Service labor is domestic. The Fed will have failed despite its efforts.

The Fed Has No Control Over This..

If Services inflation is increasing while goods inflation is dropping (it is), the Fed has had almost no effect on inflation outside of making long Oil speculators sell their positions out and crashing stocks 17%. Therefore, Fed policy is not working as of yet… (end excerpt)

Subscribers Continue Reading here

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

[ad_2]

Source link