Wharton’s Jeremy Siegel rips Fed for mishandling inflation, driving country towards ‘deep recession’

Wharton business school professor Jeremy Siegel analyzes the Federal Reserve’s policies, warning the Fed’s actions will make a ‘deep recession’ inevitable

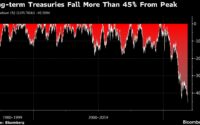

Wharton business school professor Jeremy Siegel warned Tuesday the Federal Reserve’s hawkish stance on combating inflation is sending the U.S. economy towards a “deep recession.” On “Cavuto: Coast to Coast,” Siegel unpacked the Fed’s recent rate hike and argued an “excess of monetary growth” over the past two years created the “inexcusable” problem.

US ECONOMIC DOWNTURN COULD GET ‘VERY SERIOUS’ AS FED RISKS CRUSHING DEMAND WITH RATE HIKES: JUDY SHELTON

JEREMY SIEGEL: I’ve been angry at the Fed for two years. I mean, the excess of monetary growth in 2020 and 2021 was inexcusable, in my opinion, and it’s caused all the inflation. And now they cause all this inflation, and I think they’re moving too far in the other direction. Now, your reporter was talking about those housing debt and other sales were OK, but the housing prices, the federal index went down by the most in more than 10 years. Case-Shiller actually did go down on a month-to-month basis. So, home prices are going down. And by the way, this has lagged two months, it has accelerated over the last two months. I see inflation going down everywhere, and the Fed saying we’ve got to be tighter for longer, I think can drive this country into a recession, a deep recession.

WATCH THE FULL VIDEO BELOW:

Wharton business school professor Jeremy Siegel discusses his frustration with the Federal Reserve’s handling of inflation and the impact of the global economy on currencies.

[ad_2]

Source link