It’s Geopolitics And Geoeconomics Amateur Hour At The White House Again

By Michael Every of Rabobank

OPEC+/RBNZ divots in BOE/RBA pivots

Markets were already starting a bear market rally helped by the shifting (quick)sands of UK politics, where more policy U-turns may be underway; the Chancellor tried to suggest the Queen’s death might have played a role in the messy mini-budget launch; and one journalist notes: “This Tory conference is so amazingly messy I still can’t believe it’s real. Ministers going completely rogue, MPs barely here but still throwing shade left, right & centre, Tory members downing champagne while half laughing/half crying “we’re all f****d”. It’s WILD.” That Keystone Cops dynamic had already led to the desperate “not QE or MMT!” actions of the BOE.

Then the RBA only hiked 25bp, not the 50bp 80% priced in, front-running even its own dovish pivot. “The Board is committed to returning inflation to the 2–3% range over time. Today’s increase in interest rates will help achieve this goal and further increases are likely to be required over the period ahead,” said the Governor, knowing full well his actions would be taken dovishly and bring down expectations of the rates peak to around 3% – versus around 8% expected inflation this year; above 2% inflation until 2025; a red-hot labour market; and a government more pro-labour than capital for once.

While pivoting he noted, “inflation in Australia is too high. Global factors explain much of this high inflation, but strong domestic demand relative to the ability of the economy to meet that demand is also playing a role… national income is being boosted by a record level of the terms of trade. The labour market is very tight and many firms are having difficulty hiring workers… Wages growth is continuing to pick up from the low rates of recent years…. Given the tight labour market and the upstream price pressures, the Board will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms in the period ahead.”

So why pivot? “The expected moderation in inflation next year reflects the ongoing resolution of global supply-side problems, recent declines in some commodity prices and the impact of rising interest rates.” In other words, the RBA still thinks inflation is transitory(!); and the focus is, out of character, on the rest of the world – ‘A big economy did it and ran away.’

However, this was really all about housing: “Higher inflation and higher interest rates are putting pressure on household budgets, with the full effects of higher interest rates yet to be felt in mortgage payments. Consumer confidence has also fallen and housing prices are declining after the earlier large increases. Working in the other direction, people are finding jobs, gaining more hours of work and receiving higher wages.” In short, everyone has a job; wages are going up; but after further crazy upwards movement, housing prices are finally coming down… so time to pivot. The Bank also rolled out its “Don’t Panic!” trick to explain why housing will be OK: “many households have large financial buffers.” Yes, the ones *without* large mortgages! Everyone in markets can see it’s the Reserve Bank of Austr-house-lia.

However, despite an initial drop, AUD was not hit too hard, just as GBP has rallied in recent sessions. There is a key message in that.

While the UK and Australia were pushed off their hawkish paths by asset prices, the real focus is the US. In both cases the initial market reaction was to push *US* yields and the *US dollar* lower, pricing for a Fed pivot. If it doesn’t, then we will see the UK and Australia punished for not being to keep up the pace, with higher yields and/or much lower currencies for both.

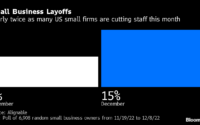

On that front, we got an important US data point in the form of the JOLTS jobs number, which saw the largest fall since 2020. That will register with the Fed. However, it cannot be looked at in isolation as presented by some: it has to be set alongside the incredible surge in jobs on offer ahead of it, which was not the pattern in 2020. Even after this decline there are still 1.67 jobs on offer for every worker. Even presuming the labour market lags, does that say pivot now when the Fed has made clear it is expecting to see higher unemployment, not a lower ratio of excess jobs available, in order to bring inflation down? Hardly!

That said, we got a speech from non-voter San Fran Fed Daly which, while excoriating inflation as a “corrosive disease” also notably added, “We have to acknowledge and understand the impact that raising the interest rate or dollar appreciation against other currencies has on global growth and on global financial conditions, because ultimately, those things feed back into onto the US.”

However, as I keep underlining, the real world is not playing ball. Indeed, alongside the lower yields and US dollar in recent sessions we have seen higher commodity prices. Moreover, besides that simple dynamic we have a geopolitical one.

OPEC+ meets today, and reportedly Russia and Saudi Arabia are combining to cut output by as much as 2m barrels a day. In other words, supply destruction to match demand destruction; so energy inflation even into a recession. And higher energy is already seeing supply destruction in fertilizers; with a lag, that will mean supply destruction in food; and then workers will demand higher wages so they can still eat.

CNN reports the White House is “having a spasm and panicking” as the most senior US energy, economic, and foreign policy officials lobby against production cuts, which some draft talking points frame as a “total disaster” that could be taken as a “hostile act.” Indeed, the US is reportedly “taking the gloves off,” and language used also includes the phrase that: “There is great political risk to your reputation and relations with the US and the west if you move forward.” What is the US going to do? Invade? Encourage the Saudis to deal more with Russia and China, reducing supply to the West even more? It is geopolitics and geoeconomics amateur hour (again)!

On which note, the EU has agreed on its Russia oil price cap, the ‘details’ of which are to be released today. One part is clear: no more EU technology to help Russian energy production, which will reduce output over time – and so push prices higher. The rest is so unclear it looks like an inverse South Park Underpants Gnomes strategy: “Step one: Russian oil price cap – Step two: ? – Step three: No Russian profit.” Greece has already agreed a carve-out for its tankers, apparently.

Relatedly, Russia is said to be moving towards either embracing all forms of crypto for payment, or a digital RUB. How do you think the US is going to respond? More light touch Wall Street crypto regulation and lower Fed Funds to allow everyone thinking of moving back into the labour market to stay at home and trade NFTs of monkeys wearing sunglasses again? Even Kim Kardashian just got slapped with a $1.2m fine by the SEC for plugging a crypto asset.

Today also saw the RBNZ hike 50bp to 3.50% and note they had discussed a 75bp move, like major central banks, not a 25bp one, like the Reserve Bank of Austr-house-lia. The NZD gained 0.9% on this news and linked comments that the RBNZ is worried about the inflation pass through from a weaker currency – which Australia should note well. (And by the way, New Zealand has a housing market they very much love too.)

Even back on the BOE, all the GBP2.22bn of Gilts it was offered at its Tuesday daily reverse auction aimed at stabilising markets were rejected. FinTwit gossip adds: “institutional Gilt broker I know, on why BoE not buying Gilts… “BOE insisting on QT commencement on the 31st Oct (which I think is ridiculous while tightening hard at the Front). BOE aren’t willing to buy these longs at Mid. All just a backstop to contain systemic risk.”

Sorry for the structural divot in your BOE/RBA pivot, Mr. Market.

Finally, Elon Musk Twitter bait-and-switched away from his ‘AI robot’, which looks like a geriatric Terminator in a nursing home that needs other robots to look after it, towards a peace-deal between Russia and Ukraine, before pivoting back to Twitter which –surprise-surprise, having signed a water-tight legally-binding agreement with him– he will be buying after all. Let’s see what now happens to Western political and market debate: it can’t get much worse to be honest.

[ad_2]

Source link