Paul Tudor Jones believes we are in or near a recession and history shows stocks have more to fall

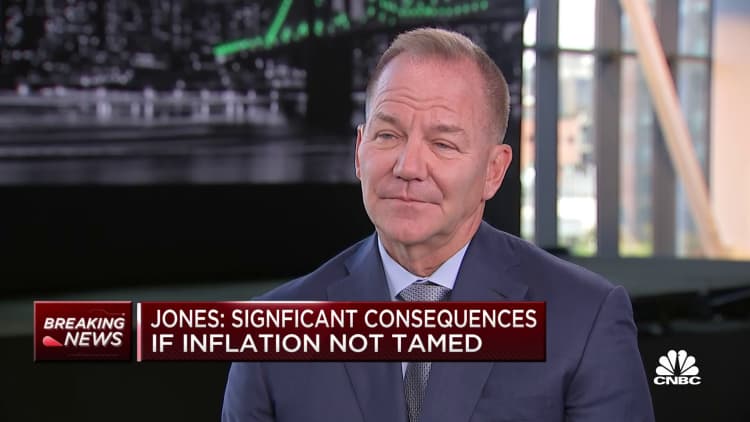

Billionaire hedge fund manager Paul Tudor Jones believes the U.S. economy is either near or already in the middle of a recession as the Federal Reserve rushed to tamp down soaring inflation with aggressive rate hikes.

“I don’t know whether it started now or it started two months ago,” Jones said Monday on CNBC’s “Squawk Box” when asked about recession risks. “We always find out and we are always surprised at when recession officially starts, but I’m assuming we are going to go into one.”

The National Bureau of Economic Research is the official arbiter of recessions, and uses multiple factors in making its determination. The NBER defines recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” However, the bureau’s economists profess not even to use gross domestic product as a primary barometer.

GDP fell in both the first and second quarters, and the first reading for Q3 is scheduled to be released Oct. 27.

The founder and chief investment officer of Tudor Investment said there is a specific recession playbook to follow for investors navigating the treacherous waters, and history shows that risk assets have more room to fall before hitting a bottom.

“Most recessions last about 300 days from the commencement of it,” Jones said. “The stock market is down, say, 10%. The first thing that will happen is short rates will stop going up and start going down before the stock market actually bottoms.”

The famed investor said it’s very challenging for the Fed to bring inflation back to its 2% target, partly due to significant wage increases.

“Inflation is a bit like toothpaste. Once you get it out of the tube, it’s hard to get it back in,” Jones said. “The Fed is furiously trying to wash that taste out of their mouth. … If we go into recession, that has really negative consequences for a variety of assets.”

To battle inflation, the Fed is tightening monetary policy at its most aggressive pace since the 1980s. The central bank last month raised rates by three-quarters of a percentage point for a third straight time, vowing more hikes to come. Jones said the Fed should keep tightening to avoid long-term pain for the economy.

“If they don’t keep going and we have high and permanent inflation, it just creates I think more issues down the road,” Jones said. “If we are going to have long-term prosperity, you have to have a stable currency and a stable way to value it. So yes you have to have something 2% and under inflation in the very long run to have a stable society. So there’s short-term pain associated with long-term gain.”

Jones shot to fame after he predicted and profited from the 1987 stock market crash. He is also the chairman of nonprofit Just Capital, which ranks public U.S. companies based on social and environmental metrics.

[ad_2]

Source link