Pension Fund Blues! Agency MBS Prices And Mortgage REITs Declining As Fed Withdraws Monetary Stimulypto (Duration Risk Increasing) – Confounded Interest – Anthony B. Sanders

Pension funds have long been investing in “safe” agency mortgage-backed securities.

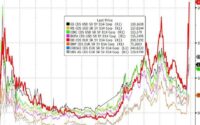

But as The Fed does its “tighten up”, we are seeing agency MBS prices falling and duration risk rising.

I remember showing my Fixed-income class at Chicago and George Mason the “MBS doom chart” showing the perils of The Fed pushing rates so low that the risk of rising rates becomes a serious problem when rates start to rise. Well, here we are … after I have retired from teaching.

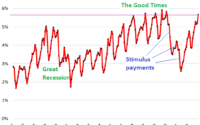

Note the double whammy of Fed rate increases and the gradual shrinking of The Fed’s balance sheet as The Fed withdraws it ample stimulus. But while The Fed was overstimulating markets, it was quite a rush.

But the rush is gone … for the moment. But “Feddie Krueger” is waiting in the wings to do it all over again!

[ad_2]

Source link