Fatter tails for US economy mean larger swings

Indeed, the VIX index, a measure of equity market volatility, dropped for three consecutive sessions in the days following the Fed policy meeting.

After the US economic data and policy releases in the past two weeks, it’s fair to wonder if the tail outcomes of the distribution curve for the US economy 12 months from now have gotten marginally fatter. This would mean a higher probability of both the upside scenario of a soft landing and the downside scenario of a hard-landing recession occurring.

But while exactly how the macro environment will eventually pan out is unknown, we can say with some confidence that fatter tails could result in sizable market swings that have become the norm this year.

Slower but higher US rates can cut both ways

First on the Fed. The main takeaway from the FOMC meeting last week is that investors should expect a “slower but higher” rate hiking cycle from here on. This implies that the odds of a 75-basis-point rate hike in December have gone down, while the odds of a terminal federal funds rate over 5% have gone up.

In terms of the outcome, this policy tweak makes both tails incrementally more likely. Moving slower reduces the risk of over-tightening as it gives the Fed more time to assess the impact that existing hikes will have on economic activity and adjust its policy accordingly. This makes a soft landing more plausible.

On the other hand, going slower risks the Fed having to do more than it otherwise would have to because inflation becomes more entrenched. That increases the risk of a harder landing, though it also pushes out the timing of when that would happen.

Slowing but diverging US economy adds to risk of tail outcomes

The US economy is showing signs of slowing, but the divergence between the goods and services sectors adds to the risk of tail outcomes. Services have grown solidly this year as consumer spending patterns normalize from pandemic distortions, while goods sectors are contracting or close to it.

In a typical economic cycle, the two sectors would move somewhat in sync. But the pandemic had the effect of initially pulling these two pendulums to opposite extremes—strong for goods and weak for services—and they’re now swinging back in the other direction.

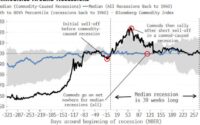

In an optimistic scenario, these forces could balance out to move more in sync, allowing the economy to muddle along toward a soft-ish landing. Pessimistically, ongoing services sector strength may keep the labor market and inflation from cooling sufficiently, thereby forcing the Fed to keep hiking rates until a hard-landing recession is all but assured.

Higher probabilities of either tail scenarios may mean wider market swings

The higher chances of both the tail scenarios do have market implications. Specifically, we can expect more volatility and large market swings exacerbated by positioning as investors update their economic outcome probabilities in reaction to each new data point and Fed comment. The S&P 500 has been exhibiting a pendulum-like return pattern this year. Large month-to-month swings could continue well into next year before the economy’s eventual destination becomes clearer.

So, we continue to believe that the risk-reward for markets remains unfavorable in the near term. As such, we advise investors to tilt their exposure toward the defensive parts of the market in stocks, bonds, and currencies. These include global healthcare and consumer staple stocks, high-quality bonds and resilient credit, the Swiss franc and the US dollar, and capital protection strategies.

Main contributors – Mark Haefele, Jason Draho, Patricia Lui, Jon Gordon, Alessia Stilli

Content is a product of the Chief Investment Office (CIO).

Original report – Fatter tails for US economy mean larger swings, 8 November 2022.

[ad_2]

Source link