Crypto and tech are the first dominoes to fall as stimulus liquidity dries up, says this money manager. Here’s what could happen next.

Read: Sequoia on its FTX investment: Some surprise to the upside, and some surprise to the downside

JPMorgan is predicting a “cascade of margin calls, deleveraging and crypto company/platform failures” linked to FTX that could last for weeks, and another 25% drop for bitcoin. On the bright side, strategist Nikolaos Panigirtzoglou says the overall crypto hit will likely be smaller than post Terra, given previous deleveraging.

Read: Technical analyst Tom DeMark says bitcoin low could come as early as Friday

Our call of the day from Stock Traders Daily and portfolio manager at Equity Logic, Thomas H. Kee Jr., links up the latest crypto selloff and selling of tech names this year to drying up of stimulus-related liquidity.

“When excessive amounts of liquidity flood the economy excessive risk-taking is a natural byproduct, but when the liquidity spigot dries up those assets that experienced irrational exuberance often reprice to more prudent levels quickly,” Kee told MarketWatch in emailed comments on Wednesday.

“Two obvious groups that benefited from the excessive liquidity influenced by stimulus were big tech, and cryptocurrencies. Each of these is being repriced now, because each of these were excessively valued due to stimulus, but these do not represent the overall market,” he said, adding that that selling could be a “precursor to conditions ahead.”

“Although crash conditions are isolated to stocks like Amazon

AMZN,

Tesla

TSLA,

Meta

META,

etc., and virtually all cryptocurrencies, the reason this is happening can affect other asset classes too, just not as acutely or immediately. The broader market, housing, private equity, bonds, all of these assets rely on new money inflows to appreciate too, and the new money from stimulus is gone,” said Kee.

What connects them all is that “new demand for these assets has dried up.”

Read: Tesla stock removed from Wedbush Best Ideas list over ‘Twitter train wreck disaster’

And with central bank stimulus no longer reliable for providing new money inflows, asset demand is now dictated by natural flows. The amount of fresh cash invested in the economy measured by the so-called Investment Rate, he said.

Dating back to 1900, that marker indicates what happens when liquidity peaks and troughs. Kee notes that the peak marks the best time to sell and troughs vice versa, for the purposes of longer-term investing.

“The immediate conditions in our economy today are not crash-like, but the excessively priced assets, those with little or no value, and those that have been hyped, are no longer able to be supported by fabricated demand. That is why big tech is down, that is why crypto has been crushed, but that does not constitute a market crash,” he said.

Kee’s proprietary Evitar Corte Model, designed to flag market crash conditions, isn’t suggesting an imminent meltdown environment right now. But he says the repricing of risk he flagged in his Dec. 21, 2021 Global Liquidity Report has happened. That report also outlined higher volatility associated with low-liquidity environments, also seen this year though it’s “not a market crash, at least not yet.”

“I expect this to spread eventually, but thus far the economic data doesn’t support a need for concern. I will be watching the FOMC and economic data for signs that this will spread. I do expect deflation to exist in retail,” he said.

As for tech, Kee said valuations matter and “those with good valuations can do just fine.” He has buy recommendations on Google parent Alphabet

GOOGL,

and Apple

AAPL,

(read what he said about Apple in September), but warns crypto is “an all out avoid.”

“There was nothing to value in the crypto market, it was pure speculation, and when free money exists, the speculation peaks. Now the free money is gone, and the speculators are not able to push it up anymore,” he said.

Best of the web

‘Is there anything about crypto that is as it seems?’ FTX failure threatens industry’s reputation in D.C.

The world’s biggest car makers are set to build millions more diesel and gasoline autos than climate goals allow.

More than a dozen wives of Russian soldiers stormed a Ukraine border town, demanding the military return their husbands

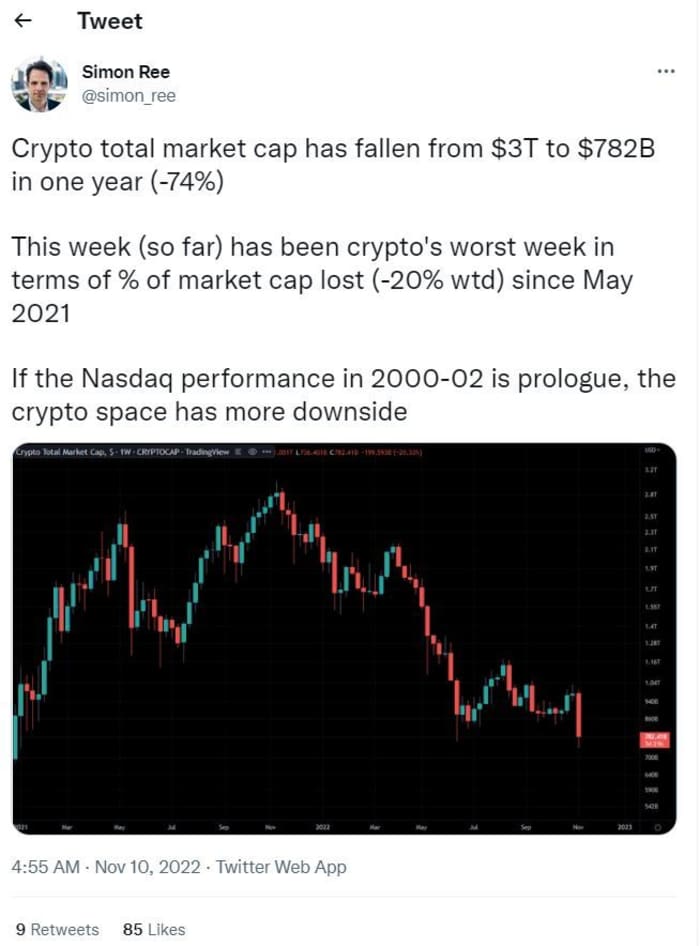

The chart

More on crypto…

Random reads

A rare gold and diamond Hermès bag is expected to sell for a record-busting $500,000 at Sotheby’s.

KFC in Germany “accidentally” told customers to treat themselves on the anniversary of Kristallnacht.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

[ad_2]

Source link