Gold slides 1% as dollar marches ahead

(Reuters) – Gold prices retreated 1% on Thursday as the dollar bounced, while recent comments from U.S. Federal Reserve officials signalled continuing policy tightening to tame inflation.

Spot gold fell 0.8% to $1,760.43 per ounce by 1:50 p.m. ET (1850 GMT), after falling to $1,753.6 earlier in the session. U.S. gold futures settled down 0.7% to $1,763.

With Fed officials expressing the need for a further slowdown in U.S. inflation, the “market interpreted that as higher rates, which made gold sell off here in the overnight session,” said Bob Haberkorn, senior market strategist at RJO Futures.

“The dollar strengthened on those comments that the Fed is still going to continue to raise rates… gold bears the brunt of higher interest rates.”

The dollar index rose 0.3%, making gold more expensive for other currency holders, and benchmark 10-year yields were higher on the day as well.

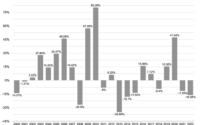

Gold vs dollar

Showing some economic strength, the number of Americans filing new claims for unemployment benefits fell last week, keeping the labour market tight despite the Fed’s aggressive interest rate hikes to cool demand in the economy.

While Fed Governor Christopher Waller on Wednesday said he would be “more comfortable” with smaller rate increases going forward, St. Louis Fed President James Bullard stated the central bank needs to continue raising interest rates probably by at least another full percentage point.

Rising rates tend to dull bullion’s appeal as it pays no interest.

Gold hit a three-month peak of $1,786.35 on Tuesday on fears of escalation of the Ukraine crisis, but prices have since eased as tensions ebbed.

Spot silver fell 2.5% to $20.93 per ounce, platinum also dropped 2.5% to $980.61 while palladium dipped 3.2% to $2,006.07.

Reporting by Seher Dareen in Bengaluru; Editing by Shailesh Kuber and Andrea Ricci

[ad_2]

Source link

Related Posts

Daily Gold Market Report | Today’s top gold news and opinion

If It Looks Like a Bailout and Walks Like a Bailout It’s Probably a Bailout