NOW A Warning?? FTX Owes Its 50 Biggest Unsecured Creditors More Than $3 Billion (Biden Leads Call For Global Bitcoin And Crypto Rules After Shock FTX Collapse) – Confounded Interest – Anthony B. Sanders

As Meryl Steep said in Death Becomes Her, “NOW a warning??”

Joe Biden Leads ‘Critical’ Call For Game-Changing, Global Bitcoin And Crypto Rules After Shock FTX Collapse. After Sam Bankman-Fried helped Democrats avoid a red wave. NOW a warning??

The chaos created by Sam Bankman-Fried (FTX Crypto Exchange) and Alameda Research (SBF’s hedge fund) will go down in history as one of the biggest scams. And should earn a top spot on Phil Hall’s 100 Years Of Wall Street Crooks.

Sam Bankman-Fried’s bankrupt crypto empire owes its 50 biggest unsecured creditors a total of $3.1 billion, new court papers show, with a pair of customers owed more than $200 million each.

FTX-linked entities owe their single biggest unsecured creditor more than $226 million, according to a redacted list of top 50 creditors filed late Saturday. All of them were listed as customers and ten have claims of more than $100 million each, the filings show.

The creditors, whose names and locations weren’t disclosed, are among the vast array of people and institutions caught up in FTX’s insolvency. The 50 largest claims are all from customers owed $21 million or more.

In the US, bankrupt companies are required to disclose information about their debts as part of insolvency proceedings. Creditors will get to weigh in on the best way for FTX to repay its debts as the bankruptcy unfolds.

FTX said it has assets and liabilities of at least $10 billion each in preliminary court papers. The case may involve more than one million creditors, according to lawyers for FTX.

The case is FTX Trading Ltd., 22-11068, U.S. Bankruptcy Court for the District of Delaware.

And then this headline from the Wall Street Journal: FTX’s Sam Bankman-Fried Cashed Out $300 Million During Funding Spree.

On top of that, SBF is attempting to raise MORE money. The question is … who would be dumb enough to listen to SBF?

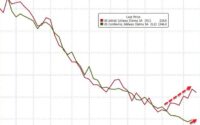

Crytpo continue to fall as investor confidence in crytpo has waned since SBF’s fraud was exposed. (In SBF’s defense, I am sure that current House Financial Services committee Chair Maxine Waters will declare he is a victim of changing market conditions, not historically massive fraud and political influence pedaling).

Didn’t SBF or his Alameda Research girlfriend Caroline Ellison look at Bitcoin as inflation roared under Biden and Fed started to remove its epic monetary stimulus? Or did any of the investors or their representatives bother to look at the books of FTX or Alameda Research??

I have the sneaking suspicion that Caroline Ellison or some other little fish will take the fall for SBF’s fraud. SBF has bought-off too many politicians.

NOW a warning from Biden??

Sam Bankman-Fried’s magical election elixir.

[ad_2]

Source link