Gold rises as Fed sees rate hikes slowing down ‘soon’

One kilo gold bars are pictured at the plant of gold and silver refiner and bar manufacturer Argor-Heraeus in Mendrisio, Switzerland, July 13, 2022.

Denis Balibouse | Reuters

Gold prices extended gains on Wednesday as minutes from the U.S. Federal Reserve’s November policy meeting showed a “substantial majority” of members opting to slow down rate hikes.

Spot gold rose 0.6% to $1,750.38 per ounce, while U.S. gold futures settled 0.6% higher at $1,750.90.

“Gold traded higher in a relief rally after the Fed minutes contained no hawkish surprises, and just about confirmed the pace of hikes would drop to 50 bps in December,” said Tai Wong, a senior trader at Heraeus Precious Metals in New York.

“The financial markets are convinced the Fed is overtightening so it is dovishly interpreting the minutes which contains no real surprises given Fed commentary the past two weeks.”

A slower pace would better allow the Federal Open Market Committee to assess progress toward its goals of maximum employment and price stability, as per the Fed’s Nov. 1-2 meeting minutes.

“Knowing that the bulk of those interest rate hikes are already factored into the market, I would say there is no longer a dark cloud of interest rate hikes looming over the gold market,” said David Meger, director of metals trading at High Ridge Future.

Higher rates increase the opportunity cost of holding non-yielding gold.

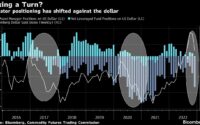

Also helping gold, the dollar was down, making gold cheaper for holders of foreign currencies, while benchmark treasury yields were also lower for the day.

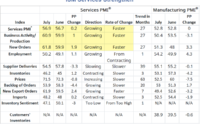

Additionally, U.S. business activity contracted for a fifth straight month in November, with a measure of new orders dropping to its lowest level in 2-1/2 years as higher interest rates slowed demand.

[ad_2]

Source link