US Mortgage Rates Plunge for a Second Week, Hit Two-Month Low, Purchase And Refi Applications Rise (But Purchase Apps Down 86% YoY, Refi Apps Down 41% YoY) – Confounded Interest – Anthony B. Sanders

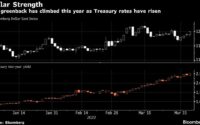

The global economic slowdown has one nice unintended consequence: as the 10-year Treasury yield softens, mortgage rates decline.

US mortgage rates retreated sharply for a second week, hitting a two-month low and providing a bit of traction for the beleaguered housing market.

The contract rate on a 30-year fixed mortgage decreased 23 basis points to 6.67% in the week ended Nov. 18, according to Mortgage Bankers Association data released Wednesday.

Rates have plunged nearly a half percentage point in the past two weeks, the most since 2008, as recession concerns mount, inflation shows signs of cooling and a number of Federal Reserve officials say it may soon be appropriate to slow the pace of monetary tightening.

The slide in borrowing costs helped stir demand as the group’s index of applications to buy a home climbed 2.8%. That marked the third-straight increase since the gauge stumbled to the weakest level since 2015.

The pickup in demand allowed the overall measure of mortgage applications, which includes refinancing, to rise for a second week, but it still remains depressed. The index of refinancing activity edged up from a 22-year low.

The Refinance Index increased 2 percent from the previous week and was 86 percent lower than the same week one year ago. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 41 percent lower than the same week one year ago.

But you need an electron microscope to see the increase in both purchase and refi apps.

One indicator of a slowing global economy is the decline of FANG (Facebook, Amazon, Netflix, Google) with declining liquidity.

[ad_2]

Source link