Bloomberg/Farah Elbahrawy and Heather Burke/11-27-2022

“Almost half of the 388 respondents to the latest MLIV Pulse survey said a scenario where growth continues to slow while inflation remains elevated will dominate globally next year. The second most likely outcome is deflationary recession, while an economic recovery with high inflation is seen as least probable.”

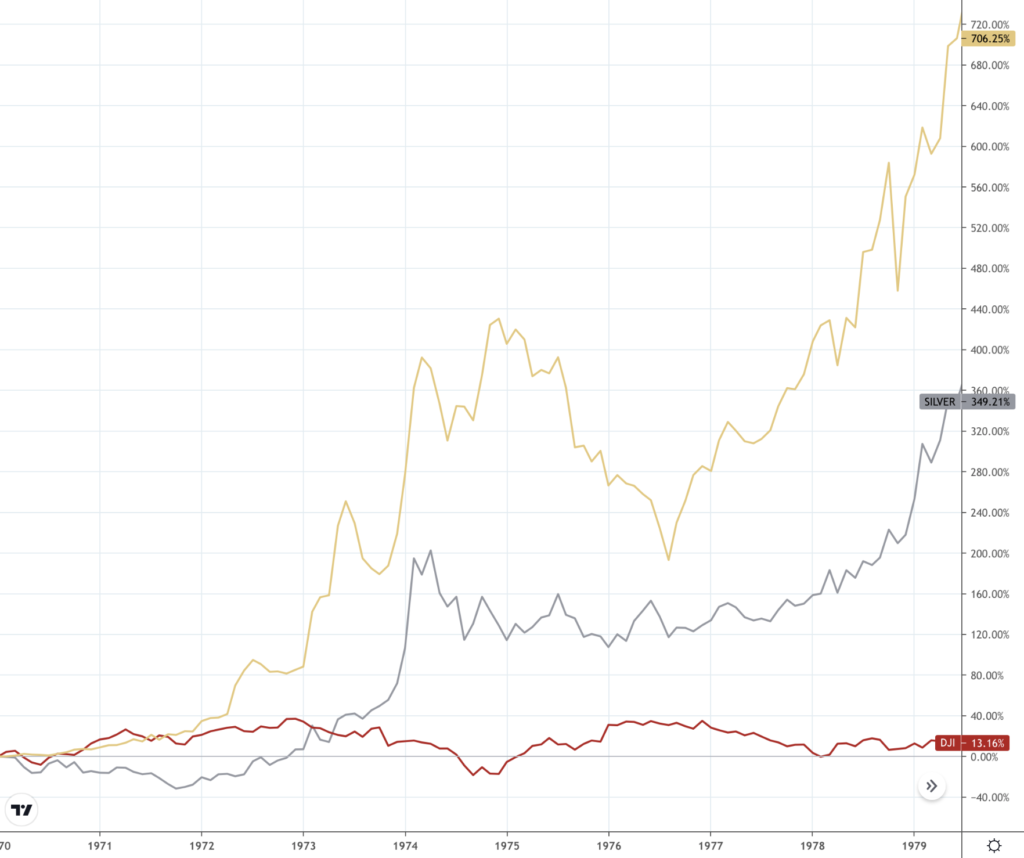

USAGOLD note: 50% of professional investors and 44% of retail investors see stagflation as the most likely economic scenario for 2023. As shown in the chart below, during the stagflationary 1970s gold and silver glittered while stocks languished.

Gold, silver, stocks in the 1970s

(%, cumulative)

Chart courtesy of TradingView.com • • • Click to enlarge