Yield Curve Is Telling Us Next Fed Cutting Cycle Could Be Big

Authored by Simon White, Bloomberg macro strategist,

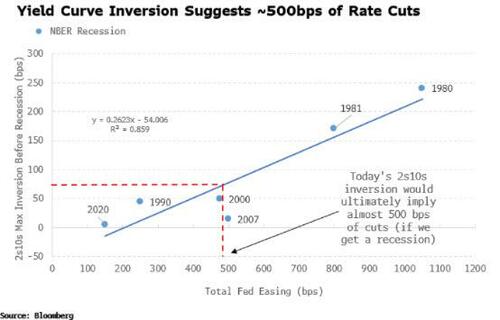

The extent of the yield curve inversion is historically consistent with almost 500 bps of Fed cuts if the US goes into a recession.

Powell’s speech on Wednesday caused a lot of consternation. He reiterated his message that, yes, the pace of rate hikes was likely to slow, but that the Fed will need restrictive policy for “some time” – aka “higher for longer”.

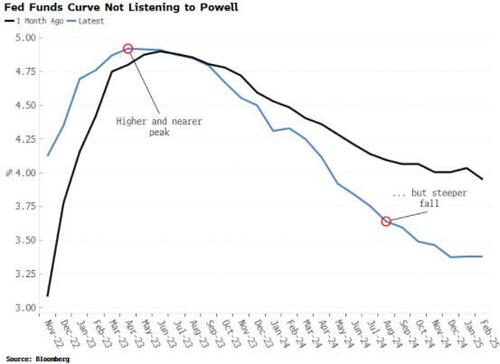

Even though the message has not changed, the market over the last month has moved the peak rate higher, but brought it closer, and priced in a much steeper subsequent pivot – “higher for shorter”, almost the diametric opposite of Powell’s sentiments.

The flattening of the back-end of the fed funds curve is highly correlated with the flattening we have seen in the yield curve. 2s10s is now as inverted as it has been since the early 1980s, but when it comes to recessions, the more imminent sign is when the curve begins to re-steepen.

The big question is, though, if we do get a recession (which looks highly likely but not imminent), when and by how much will the Fed cut rates?

The market sees the first full 25 bps cut by November next year – I would hazard it will come sooner, based on leading indicators that are consistent with a potentially deep recession.

But the size of the yield-curve inversion suggests the depth of Fed cuts could be enough to take rates back towards the zero bound.

There is a strong relationship between the maximum inversion of 2s10 before a recession, and the total sum of Fed cuts that come after.

The current inversion in 2s10s is historically significant with almost 500 bps of Fed cuts, which, based on where the Fed rate is expected to peak, would mean a reversal of virtually all of the Fed’s hikes.

The Fed may live up to its own hype and keep rates very restrictive. But talk is cheap, and the truth of the matter is the Fed has not yet had to face the pressure from keeping rates high, continuing with QT, while unemployment is beginning to materially rise. In the 1974 recession, the Fed cut rates almost 800 bps in a period where inflation was above 9%.

The market currently anticipates about 150 bps of cuts. The high likelihood of a recession and the depth of the yield curve’s inversion suggest this is on the low side.

[ad_2]

Source link