Fed’s Favorite Inflation Signal Dips (Holds Near 40 Year Highs) As Savings Rate Crashed

Among The Fed’s favorite inflation indicators – it has apparently got many and picks and chooses as it pleases – is the Core PCE Deflator. Both the headline and core deflators dropped from September’s levels (+6.0% vs +6.3% prior and +5.0% vs +5.2% prior respectively)…

Source: Bloomberg

Of course, while this will be greeted with euphoria – ‘peak inflation’ – we do note that it is still the highest levels since 1983…

Source: Bloomberg

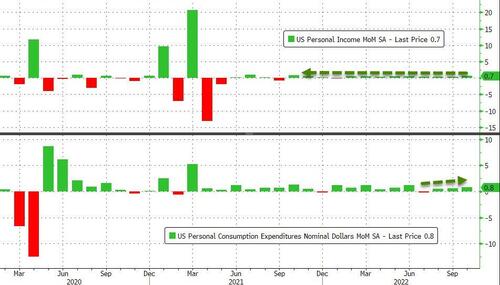

Americans’ income and spending were both expected to rise once again in October and they did with incomes rising 0.8% MoM (double expectations) – the biggest jump since Oct 2021. Spending also accelerated, rising 0.8% MoM (as expected)…

Source: Bloomberg

Adjusted for inflation, real personal spending rose 0.5% MoM – the biggest jump since Jan 2022…

Source: Bloomberg

But on a YoY basis, real personal spending rose 1.78% – the weakest rise since Feb 2021…

Source: Bloomberg

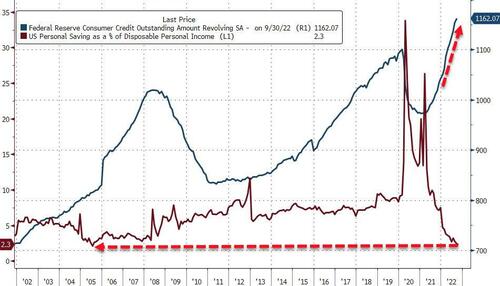

Finally, against all that, Americans’ savings rate plunged to just 2.3% of disposable income – the lowest since July 2005…

Source: Bloomberg

Reflecting on Powell’s comments, this de minimus drop in PCE Deflator does nothing to alter the path of Fed rates and the fact that the savings rate is nearing record lows suggests the consumer is on the brink of capitulation.

[ad_2]

Source link