Investors may have gotten overly excited this week about comments from Fed Chairman Jerome Powell.

The Fed chief’s suggestion of a 50 basis point hike vs. 75 bp in December wasn’t new, says the founder & CEO of BullAndBearProfits.com, Jon Wolfenbarger. But his dovish tone could lead to looser financial conditions, bringing with it higher inflation, and more rate hikes to control that, he tells MarketWatch in an interview.

The former Wall Street investment banker warns that the cards are stacked against equity markets for the foreseeable future, and offers charts to back that up.

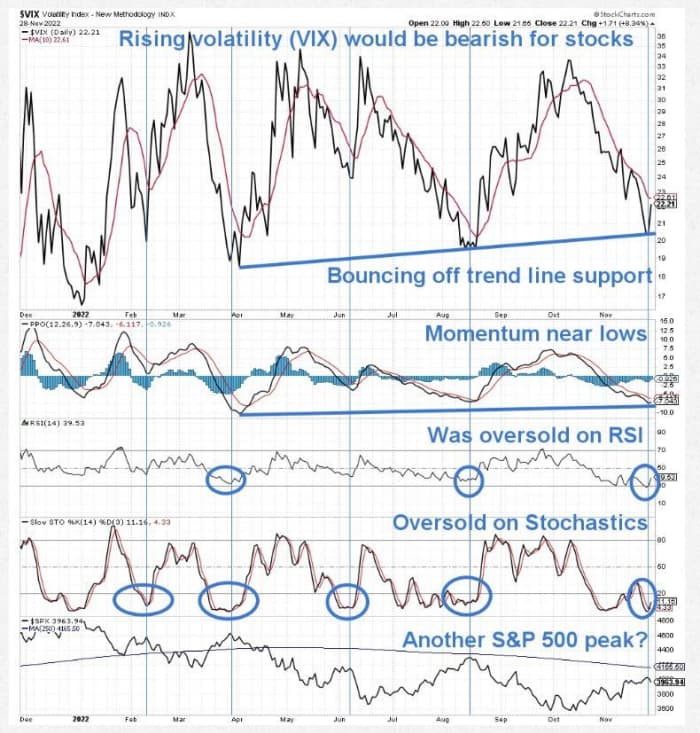

From his latest blog post is this one showing the CBOE Volatility Index, or the VIX

VIX,

bouncing off a trend line that in the past has shown prior bottoms for that index and peaks in the S&P 500 this year:

BullandBearProfits.com

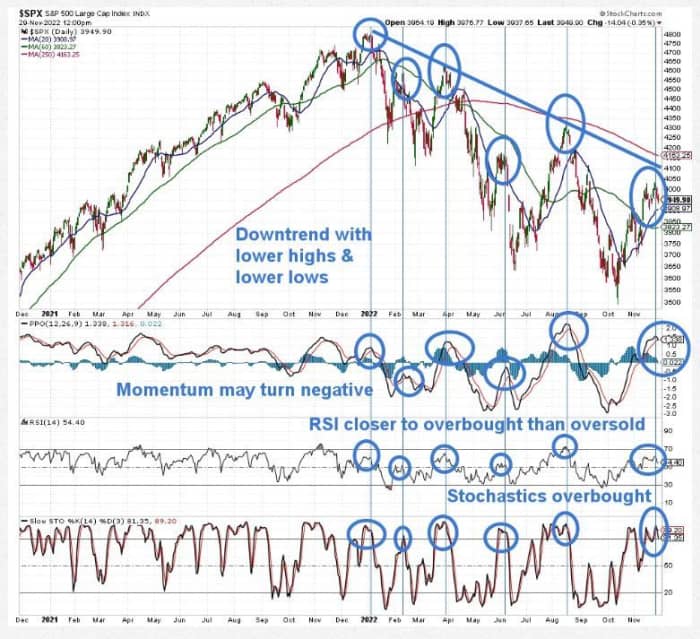

The next chart shows the S&P 500 in a “clear bear market downtrend with lower highs and lower lows” and trading under its 250-day moving average (red line) and downtrend line (blue line), he says:

BullandBearProfits.com

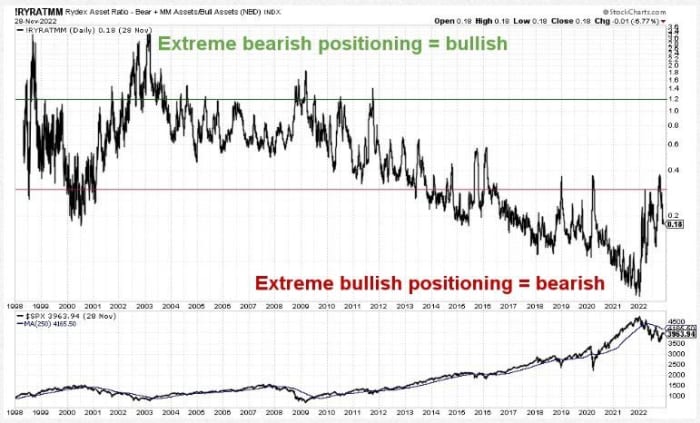

Then there’s all that bullishness, despite a nearly year-long bear market, That bull/bear ratio reached historically bullish levels at the early 2022 market peak and remains in very bullish territory, he said.

BullandBearProfits.com

“This bearish technical setup for the stock market, combined with overly bullish investor sentiment in the face of the Fed hiking rates into a recession, suggests that the stock market is likely to start another major bear market selloff soon,” said Wolfenbarger, who sees that recession starting any day and ending around late 2023 or early 2024.

Far from more optimistic forecasts seen elsewhere on Wall Street, the money manager is targeting 2,250 for the S&P 500, a 43% tumble from current levels, though a bottoming in mid-2023. That bear market will last a total of 18 months, not far off the 17-month bear market seen in the Global Financial Crisis.

But don’t rev up the shopping carts just yet. “Based on current valuation levels for the stock market that are near the 2000 Tech Bubble and 1929 peaks, the S&P 500 is likely to be at least 25% lower in 10 to 12 years,” he predicts.

His advice? Sell “risk on” assets like stocks, commodities (including energy stocks, which will drop along with oil as a recession kicks in) and cryptocurrencies — highly correlated with tech stocks. Treasury bonds will be riskier than normal during a recession owing to high inflation, he adds.

“For those who are risk-averse and want to wait this bear market out until the next bull market starts, you can buy safe and relatively high yielding Treasury bills and floating rate notes,” said Wolfenbarger, who suggests ETFs, such as the SPDR Bloomberg 3-12 Month T-bill ETF

BILS,

and the WisdomTree Floating Rate Treasury Fund ETF

USFR,

For aggressive investors looking to profit more significantly from a bear market, he suggests inverse ETFs that rise when stocks fall, such as ProShares Short S&P 500 ETF

SH,

and ProShares Short QQQ

PSQ,

Those who want to be even more aggressive, can buy double inverse ETFs such as ProShares UltraShort S&P 500

SDS,

and ProShares UltraShort QQQ ETF

QID,

An investor looking to profit from falling oil prices could buy double inverse oil ETF ProShares UltraShort Bloomberg Crude Oil

SCO,

“After the Fed starts cutting rates and the recession becomes well-entrenched, we will look for stocks to become very oversold (we focus on key technical indicators for this such as Weekly & Monthly RSI and Bollinger Bands) to take profits from this bear market and then position for the next bull market with individual stocks and long and levered-long ETFs,” he says.

Read: One of Wall Street’s biggest bulls now sees stocks falling early next year as Fed ‘overtightens’

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

Best of the web

Sam Bankman-Fried said he cares most about helping humanity in trying to explain the FTX collapse.

Elon Musk says his Neuralink brain implants could be ready for human trials in six months. Curing paralysis is one of the goals.

The benefits of “freudenfreude” — finding happiness in another person’s good fortune

The chart

Random reads

Kanye West’s monthly child support bills? $200,000

UNESCO Heritage status finally arrives for the French baguette

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.