US Mortgage Rates Fall A Fourth Week, Longest Stretch Since 2019 (Mortgage Applications Rise, But Refi Apps Remain Low -86% YoY And Purchase Apps Are Down -40% YoY) – Confounded Interest – Anthony B. Sanders

The US mortgage market is like Mussgorsky’s Pictures at an Exhibition. Where are the paintings are bad.

US mortgage rates fell for a fourth week in a row, the longest such stretch of declines since May 2019.

The contract rate on a 30-year fixed mortgage eased 8 basis points to 6.41% in the week ended Dec. 2, still the lowest since mid-September, according to Mortgage Bankers Association data released Wednesday.

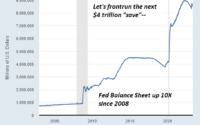

Rates have retreated for the past month as the Federal Reserve has signaled it will soon slow down the pace of interest-rate hikes, likely at next week’s policy meeting.

Even so, MBA’s mortgage purchase index fell 3%, the first drop in five weeks, underscoring how demand remains fickle and driving a decline in the overall measure of mortgage applications. On the other hand, refinancing activity rose last week, but remains near the lowest level in two decades.

Here is a chart of mortgage applications from the Mortgage Bankers Association showing the decline in US mortgage rates, and increases in mortgage purchases and refi applications. The Refinance Index increased 5 percent from the previous week and was 86 percent lower than the same week one year ago. The unadjusted Purchase Index increased 31 percent compared with the previous week and was 40 percent lower than the same week one year ago.

The MBA survey, which has been conducted weekly since 1990, uses responses from mortgage bankers, commercial banks and thrifts. The data cover more than 75% of all retail residential mortgage applications in the US.

[ad_2]

Source link