- Gold rises to highest level in half a year

- (.DXY) down 0.2%

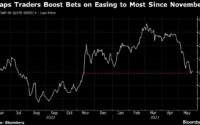

- Benchmark 10-year yields reach highest level since Nov. 15

- China to drop quarantine rule for inbound travellers

Gold jumps to six-month high on China reopening optimism

December 28, 2022

Dec 27 (Reuters) – Gold prices jumped to their highest level in six months on Tuesday as optimism surrounding decisions by top consumer China to further ease COVID-19 restrictions weighed on the dollar, while benchmark U.S. yields limited gains.

Spot gold jumped 1.1% to $1,816.69 per ounce by 1:52 p.m. ET (1852 GMT), rising to $1,832.99 earlier in the session, its highest level since June 27.

U.S. gold futures settled up 1.1% at $1,823.1.

“Gold is following the decisions by China to further ease COVID restrictions,” on the anticipation of higher demand from the region and in spite of rising yields, said Bob Haberkorn, senior market strategist at RJO Futures.

The dollar index edged lower and benchmark 10-year yields held close to their highest levels in over a month.

Gold has gained nearly $200 after falling to a more than two-year low in late September, as expectations about slower interest rate hikes from the Fed dimmed the dollar’s allure and lowered the opportunity cost of holding bullion, which pays no interest.

Top gold consumer China relaxed quarantine rules, in a major step toward easing curbs on its borders, which have been largely shut since 2020.

“The gold futures bulls have the overall near-term technical advantage. Prices are in a seven-week-old uptrend on the daily bar chart,” with the first resistance at $1,825 an ounce, said Jim Wyckoff, senior analyst at Kitco Metals, in a note.

In other metals, spot silver gained 1.6% to $24.09 per ounce, while platinum edged up 0.2% to $1,023.73.

Palladium jumped nearly 4% to $1,832.44, earlier in the session hitting its highest level in over a week at $1,839.66, on news about China opening up.

“We continue to see palladium as the stronger of the two metals (platinum and palladium) almost specifically due to supply constraints,” said David Meger, director of metals trading at High Ridge Futures.

Reporting by Seher Dareen in Bengaluru, Editing by Louise Heavens, Matthew Lewis and Shailesh Kuber

Our Standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link