Gold ended higher on Friday, with prices for the yellow metal logging their fifth straight weekly gain as investors monitored falling bond yields and fears of an economic downturn.

Price action

-

Gold for February delivery

GC00,

+0.20% GCG23,

+0.20%

rose $4.30, or 0.2%, to settle at $1,928.20 an ounce on Comex, for a weekly rise of 0.3%, according to Dow Jones Market Data. Gold ended at a nearly 9-month high and has rallied 5.6% so far in 2023. -

March silver

SIH23,

+0.80%

rose 7 cents, or 0.3%, to $23.935 an ounce, with prices down 1.8% for the week. -

April platinum

PLJ23,

+1.04%

rose $6.70, or 0.6%, to $1,047.80 an ounce, ending the week 2.3% lower, while March palladium

PAH23,

-2.18%

dropped $45.30, or 2.6%, to $1,723.20 an ounce, posting a 3.6% weekly loss. -

March copper

HGH23,

+1.13%

added 2 cents, or 0.5%, to settle at $4.2515 a pound, up 0.8% for the week and gaining 11.6% year to date.

Market drivers

January almost always sees gold prices rise in dollar terms but this year, “the hot money has run into Comex, as well as Shanghai futures and options, betting that prices will keep surging on chatter over heavy central-bank demand, plus the strong household buying expected in China for the Lunar New Year holidays,” said Adrian Ash, director of research at BullionVault.

However, “a pullback in gold could very well come next week, when China’s Spring Festival will shut both Shanghai’s gold and its futures exchanges,” he told MarketWatch. “That will remove a big chunk of physical demand as well as leveraged speculation from the market.”

This week, gold found support, up a fifth straight week — the longest such streak of gains since August 2020, as Treasury yields and the dollar have retreated from late 2022 highs as investors have monitored a slowdown in U.S. inflation.

Treasury yields were higher on Friday but the 10-year yield

TMUBMUSD10Y,

was on track for a weekly decline. Lower yields reduce the opportunity cost of holding nonyielding assets like gold.

The ICE U.S. Dollar Index

DXY,

was on track for a modest weekly loss, down around 11% from a 20-year high set in October. A weaker dollar can be supportive for commodities priced in the unit, making them less expensive to users of other currencies.

“The fact that gold has been able to make such large gains, to now be trading close to its highest level since April, even though another rate hike is near certain when the Fed next meets, continues to surprise. Gold really has caught a fair wind and is sailing ever higher on it,” said Rupert Rowling, market analyst at Kinesis Money, in a note.

“The lingering concern remains however that gold has climbed so much already before the Fed, and other central banks, actually hit pause on their rate hikes and this leaves the precious metal highly vulnerable to a sudden price drop if interest rates don’t stop climbing as soon as anticipated,” he wrote.

Still, “investors are starting to discount a recession and a Fed pivot after the fastest rate hike cycle ever,” Jeb Handwerger, editor of newsletter service Gold Stock Trades, told MarketWatch.

““ Investors are flocking to real assets like precious metals, and junior minors, as a safe haven from a declining dollar”

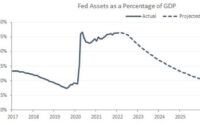

“Investors are flocking to real assets like precious metals, and junior minors, as a safe haven from a declining dollar…” he said. The Federal Reserve has already pivoted from 0.75 percent point rate hikes to 0.5 point increases, and is “increasingly expected to shift to 0.25 increments.”

See: Fed’s Waller backs quarter-point rate hike at upcoming meeting

Gold futures on Jan. 13 posted a golden cross, which happens when a short-term moving price average crosses above a long-term moving average.

That “may indicate the start of the next breakout into new highs” going past $2,000, said Handwerger.