Subprime Auto-Loan Delinquencies Rise to 2019 Levels: a Dive into Subprime Lending and Securitizations

Surge of delinquencies not caused by unemployment, but by taking Big Risks, hoping for Big Profits, and getting slapped, just as in 2019.

By Wolf Richter for WOLF STREET.

Delinquencies of subprime auto loans have bounced off the stimulus-fueled low levels during the pandemic, when borrowers got caught up on their auto loans with the money they got from stimulus checks and extra unemployment benefits, and from not having to make mortgage payments because they’d entered their mortgages into a forbearance program, and from not having to make rent payments because of the eviction bans. Most of this has now ended, and the money is gone, and subprime delinquency rates are surging.

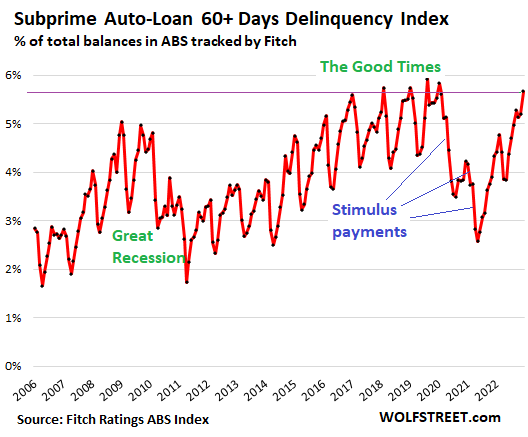

Subprime delinquency rate rises, still below 2019 Good Times.

In December, the subprime auto-loan 60-days-and-over delinquency rate rose to 5.7% of total auto loan balances in the Asset-Backed Securities (ABS) rated by Fitch Ratings. The record in the 21st century was set in August 2019, the Good Times, of 5.9%.

Prime-rated auto loans are in pristine conditions.

Delinquency rates of “prime” rated auto loans are near record lows of a minuscule 0.2%, according to Fitch Ratings. During the worst moment of the Great Recession in January 2009, the prime delinquency rate rose to 0.9%, still minuscule. Prime auto loans are a low risk, low yield business.

Subprime-rated auto loans and Asset-Backed Securities (ABS).

Auto loans are rated subprime for the same reason a lot of bonds are rated “junk” (BB+ and below): the borrower has a much higher risk of defaulting on the debt.

Investors buy them because they get paid higher yields to compensate them for taking those higher risks. Subprime auto loans, just like junk bonds, are a high-risk business with potentially high profits and high losses.

Subprime loans on used vehicles come with interest rates on average of 15% to 20%, depending on how deep they’re into subprime, according to Experian. Investors are willing to take high risks to get these kinds of juicy yields.

Much of the subprime lending is done by a coterie of specialized lenders. Most of the subprime auto loans are packaged into Asset-Backed Securities (ABS) that investors such as bond funds and pension funds purchase for their higher yields.

ABS are structured with the equity tranche and the lowest-rated tranches taking the first losses. As losses increase, higher-rated tranches are starting to take losses. The top-rated tranche of a subprime-auto-loan ABS, perhaps rated “AA” (my cheat sheet for credit ratings of corporate bonds), will only take losses if there is severe damage to the ABS from defaults.

Tranches with high credit ratings carry the lowest yields, and investors that are more risk-averse buy them. Low rated tranches are bought by risk cowboys. And the lowest tranche is usually retained by the subprime lender that originated the loan – the required skin in the game, which is one of the reasons why small specialized lenders can go belly-up.

Subprime lending has been around for decades and is rife with abuses and scandals. Some subprime loans come with such huge interest rates that practically guarantee that the loans will default. Some subprime lenders take huge risks in their underwriting practices.

Occasionally regulators crack down, and so there are settlements and fines that subprime lenders consider part of the cost of doing business. And periodically, specialized lenders go belly-up because something didn’t pan out. The risk-taking is driven by high yields, and by the ease with which a vehicle can be repossessed and sold at auction.

In the years before the spike of used vehicle prices that started in 2020, the proceeds from auction sales covered 40% to 50% of the defaulted loan balance of subprime auto loans (the “recovery ratio”), according to Fitch Ratings.

But as used vehicle prices spiked from late-2020 through early 2022, the recovery ratio soared. For subprime auto loans, the recovery ratios exceeded 70% in 2021, far above any prior records, according to Fitch. Used vehicle prices are still very high but are now falling. So the recovery ratios are declining and will get back to around 40% to 50%.

Subprime, a small part ($210 billion) of total auto loans & leases ($1.52 trillion).

Subprime loans are largely focused on used vehicles with smaller amounts financed and make up only a small portion of the overall outstanding auto debt. So here are some basics about the magnitude of subprime auto loans, based on Experian’s Q3 report (it defines “subprime” as a credit score of 600 or below):

- Only 13.7% of overall outstanding balances of auto loans were subprime.

- Only 15.8% of the total number of loans and leases originated in Q3 were subprime.

- Only 5.2% of the number of new vehicle loans originated in Q3 were subprime.

- But 22.4% of the number of used vehicle loans originated in Q3 were subprime.

- Average amount of used vehicle loans originated in Q3: $28,506

- Average amount of new vehicle loans originated in Q3: $41,665.

Total auto loans and leases outstanding amounted to $1.52 trillion in Q3, according to data from the New York Fed. With 13.7% of the outstanding balances being subprime, the total amount of subprime-rated auto debt amounts to about $210 billion, most of which is owned by investors that bought the ABS.

Delinquencies driven by risk-taking in Good Times, not unemployment.

Note in the chart near the top of the page: The delinquency rate plunged from early 2010 through the spring of 2011 – during the Bad Times, during the unemployment crisis, the result of risks in new lending having been dialed back.

As you can also see in the chart, when the Fed continued to repress interest rates in 2011 and on, investors went on a wild chase for yield, and the risk taking increased across every asset class, including in subprime auto loans. This enthusiastic risk-taking caused the subprime delinquency rate to surge during those years and in August 2019, the Good Times, to hit a 21st-century record.

It was during these Good Times in mid-2019 that a gaggle of smaller specialized subprime auto lenders, owned by private equity firms, collapsed into bankruptcy, which I covered at the time.

This August 2019 record – and the bankruptcies of the specialized lenders – occurred while the job market was hot and unemployment very low. It occurred because these small lenders had been taking huge risks for years, to gain a big yield, in a world where yield had become scarce.

Despite this high delinquency rate in 2019, and the collapse of some of the smaller lenders, the auto lending business remained profitable for lenders that had managed their risks appropriately.

So the surge in delinquencies through 2019 was not caused by an employment crisis, but by increased risk taking beforehand.

The same thing now: The surge in delinquencies is not caused by any kind of unemployment crisis or whatever – the job market is historically tight and wages are surging – but by risk taking in 2020 through 2022.

The risk taking was further fueled by the mind-boggling spike in used vehicle prices when many of these loans were made, seducing lenders into thinking that they would get very high recovery rates for the loans that defaulted. And they did get record high recovery rates for a while. But they’re now coming down.

Despite the surge in delinquency rates back to the Good Times of 2019 levels, losses of subprime loans in the ABS that Fitch tracks have remained below those of 2019. In December, the Subprime Auto Loan Annualized Net Loss Index by Fitch rose to 8.3%, but this was still well below the 9.7% in December 2018, and 9.4% in December 2019.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link