Eventually Has Finally Arrived! – Miller on the Money

When the Fed bailed out the banks in 2008, flooding the system with trillions, you just knew high inflation would be the result. It just had to happen!

When the Fed bailed out the banks in 2008, flooding the system with trillions, you just knew high inflation would be the result. It just had to happen!

The government jumped in, borrowing trillions more at historically low interest rates. Not willing to let rates rise to free market levels, the Fed simply created money for the government and put it on their balance sheet, raising it from $1 trillion in 2006 to around $9 trillion.

The pace accelerated, doubling since 2020. “Tax and spend” became “Print and spend.”

When governments create money out of thin air, it devalues the currency – a process called inflation. Since 2008, we just knew high inflation was inevitable – but it didn’t happen.

When governments create money out of thin air, it devalues the currency – a process called inflation. Since 2008, we just knew high inflation was inevitable – but it didn’t happen.

Where was the inevitable inflation?

Former colleague Doug Casey preached, “Just because something is inevitable, does not mean it is imminent.” We changed our tune. Deep down, we knew inflation was going to rear its ugly head – sooner or later – eventually! All fiat currencies eventually fail.

“You can’t fight the Fed”.

| “The markets can remain irrational longer than you can remain solvent.”

— John Maynard Keynes |

Many investors bet on the inevitable, and lost money because what they thought was imminent never happened.

Low inflation was worldwide. Currencies trade in pairs. Inflation is when a currency loses value in relation to other currencies. The world banks all binged on currency creation, while their governments spent trillions they didn’t have. By coordinating their efforts, these world banks created relative parity among major currencies.

The Covid crisis caused the US government to create record debt in a short period of time. In two years, US debt jumped around 25%, approaching $32 trillion, with no end in sight.

The rapid debt increase ignited the inflation skyrocket. The Fed ignored the obvious, saying inflation was “transitory”. As inflation approached double digits the Fed had to do something, the public was catching on. They set a 2% inflation target. Despite tough talk, their small rate increases were mere baby steps along the walk. Unlike the Volcker years, interest rates are still below the rate of inflation.

The rapid debt increase ignited the inflation skyrocket. The Fed ignored the obvious, saying inflation was “transitory”. As inflation approached double digits the Fed had to do something, the public was catching on. They set a 2% inflation target. Despite tough talk, their small rate increases were mere baby steps along the walk. Unlike the Volcker years, interest rates are still below the rate of inflation.

Chuck Butler recently told us “Eventually has come!”

Chuck Butler recently told us “Eventually has come!”

The Fed’s easy money and historic low interest rates created an illusion.

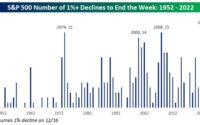

- The stock market soared, not based on sound business fundamentals, because cheap money had no place else to go.

- Governments, not concerned about raising taxes, or high interest costs, went on spending binges taking US and world debt to historic proportions.

- Private industry jumped in, borrowing billions to buy back their stock (at high prices) and paid out dividends – that their profits did not justify.

Eventually has arrived and the necessary corrections will take place – one way or another. Several things are converging all at once.

Some pundits are already screaming that the Fed must reverse course. If the Fed waffles, inflation will soar; inevitably our currency will go the way of Zimbabwe and become worthless. Much of the nation’s remaining wealth will be destroyed.

| “If you are going through hell, keep going.”

— Winston Churchill |

If the Fed does as Volcker did, truly bring inflation back down, interest rates will continue to rise. As existing public and private debt matures, it will have to be paid off, or refinanced at much higher rates, negatively affecting corporate profits. We may see bond defaults in double digits. The sky-high stock market bubble has to pop – a major market correction. The process won’t be pretty, but it is necessary for our economy to survive.

Prudent investors will “eventually” be able to lend money, earning safe, reliable, inflation-beating interest, while also finding some terrific investment bargains.

Political accountability

Political accountability

The political implications are looming. Since the bailout congress spent trillions, without raising taxes, and no accountability for their actions. The consequences are now coming home to roost!

Alasdair Macloed writes: (Emphasis mine)

“…. Unless the Fed and other central banks lighten up on their restrictive monetary policies, a stock market crash is bound to ensue.

…. For the Fed, preventing a stock market crash is almost certainly a more immediate priority than protecting the currency.

The private sector establishment errs in thinking that the choice is between inflation or recession. It is no longer a choice, but a question of systemic survival.

A contraction in commercial bank credit and an offsetting expansion of central bank credit will almost certainly take place. The former leads to a slump in economic activity and the latter is a commitment too large for an inflating currency to bear.

…. The inconvenient truth is that policies of monetary stimulation invariably end with the impoverishment of everyone.“

| “I think 2023 will be worse than 2022 – market volatility-wise, economy-wise, and inflation-wise… I don’t see anything coming in 2023, that doesn’t scare the bejeebers out of me!”

— Chuck Butler |

Fixing the mess will cause economic pain. Our society survived the Great Depression; we will get through this. Prepare for the worst and do more than just hope for the best.

I fear the Fed won’t have the courage of Volcker; seeing things through until inflation is under control. If they reverse course, it will prolong the process and pain for all; allowing politicos to continue their charade.

If you don’t solve the cause, you don’t solve the problem!

Thanks to reader Zeus who sent me a link to the Treasury Department monthly statement.

The graph, “Cumulative Receipts, Outlays, and Surplus/Deficit through Fiscal Year 2022 reveals the sad truth:

The government deficit for the fiscal year 2022 was $1.3 trillion. Cumulative debt is $32 trillion and climbing.

The government deficit for the fiscal year 2022 was $1.3 trillion. Cumulative debt is $32 trillion and climbing.

Each 1% interest rate increase will cost taxpayers $320 billion in additional interest cost. Current interest rates are around 4%. Interest cost on our national debt will rise to over $1.3 trillion annually.

Victor Davis Hanson tells us:

“Federal tax revenue has increased almost every year since 2010. Sometimes it has grown by nearly a half-trillion dollars per annum, even as we sink deeper in debt.

“Federal tax revenue has increased almost every year since 2010. Sometimes it has grown by nearly a half-trillion dollars per annum, even as we sink deeper in debt.

Our crisis, then, is one of spending what we do not have rather than one of declining revenue.”

The Fed can stop printing and raise rates until hell freezes over, but until the government stops ridiculous spending, our economy and way of life will suffer.

Richard Maybury’s recent newsletter provides some political insights:

“If people in office will not reduce the size and power of the government, the next best thing is gridlock, meaning neither political party dominating or cooperating with each other.

…. As Sean Lengell wrote for the Kiplinger website, ‘A bitterly divided Congress will fight over everything.’

…. As Sean Lengell wrote for the Kiplinger website, ‘A bitterly divided Congress will fight over everything.’

If you can’t get rid of government…paralyze it. Despite what we were taught in school, this was the real philosophy behind the whole American system. The purpose of the Constitution was to create political gridlock.”

When I see a “bipartisan spending bill” I cringe. “Bipartisan” means politicians cooperate with their political opponents and spend trillions on all their pet projects, resulting in enormous deficits and borrowing costs.

The $1 trillion “inflation reduction act” was rushed through the lame-duck congress at the end of the session – knowing it would have little chance of passing in 2023. Shame on them, one and all.

|

National Upheaval: Threats and opportunities appear every day, and the EARLY Warning Report is aptly named. Find out about events early, before they hurt you and while they can still help you. Join the informed group of readers who can’t wait for their next issue of Early Warning Report – and all the profit potential and understanding it delivers. Click here right now and save $102 off the regular subscription price of $300. When you join, we’ll immediately email your 4 FREE bonuses:

|

What can we do?

| “We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power.”

— Alan Greenspan |

Remember, gold is real money. If the Fed balks, inflation will rise well beyond that of the Volcker years. Investors must protect their accumulated wealth. Precious metals and tangible assets will retain their buying power.

Have faith in good businesses. While profits may suffer, good companies will survive. As Tim Plaehn said, they will continue to pay dividends. Expect stock prices to drop, presenting some great investment bargains. Good businesses survive, and thrive in the toughest times.

Don’t get sidetracked by the political hype. Politicos will blame their opposition, positioning themselves as our savior. Politicians will never take responsibility for creating the financial mess we are experiencing.

When things get bad enough, no member of the political class will be immune. I’m hoping for peaceful political turmoil. I’d love to see the two-party system destroyed; being replaced with politicians that no longer rule against the will of the majority, and actually represent the voters that hired them.

What about the gold standard?

Herman Cain and Judith Shelton, advocates for return to the gold standard, were nominated for spots at the Federal Reserve. The political class deemed them as “too radical.” The gold standard would force politicians to control spending.

Former Fed Chief Alan Greenspan tells us: (Emphasis mine)

“The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.

“The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.

Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. …. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

I’m hoping the politicos panic, look for a scapegoat, eliminate the Fed, break up the “too big to fail” banks, and we return to gold-backed currency.

We will get through this together and emerge stronger – eventually!

|

A little help means a lot! Eight years ago, I vowed to keep our newsletter FREE! I plan to keep my promise. It’s an expensive, time-consuming hobby, but also a labor of love. Recently a reader asked why I didn’t charge for our weekly letter. I explained that I want it available for everyone. Some readers may be on limited budgets and may benefit the most from our advice. He pressed on with his questions. How much does your letter cost? How many readers do you have? He concluded, “If each reader paid $10/year, you would be fine. I responded, “Yes, $10 per reader would work, BUT I am committed to keeping it FREE even if it costs me money.” Several readers suggested we add a donations button to help us offset the cost of our publication. It helps when people pitch in and we certainly appreciate it. If readers want to donate, it sure helps out, however, it’s strictly voluntary – no pressure – no hassle! Click the DONATE button below if you’d like to help. You do not have to sign up for PayPal to use your credit card. And thank you all! |

On The Lighter Side

Last week we had some heavy winter storms move across the country. Jo found a neat live cam in Flagstaff, AZ. Flagstaff averages around 100 inches of snow annually. Last week they reported close to 18″.

As we watched the blizzard cover the ground on TV, I looked out the window to sunshine and temperatures in the 60s. Growing up in the midwestern plains, I still find it amazing that we can drive three hours up into the mountains and be in the dead of winter.

Jo commented she would love to be in a nice, warm hotel room with a fireplace, looking out the window at the beautiful snow. Not me; watching it on TV works just fine.

I found another live cam overlooking Mallory Square in Key West, FL. A favorite event for Key West visitors and residents alike is watching the beautiful sunset every evening. Jo and I have done that many times and they can be breathtaking.

Today, January 26th, Key West sunset is scheduled for 6:08PM Eastern time. Tune in a few minutes early and hopefully it will be beautiful.

I flipped back and forth between the cams, reminding myself how lucky we are to be able to choose a climate we enjoy. I’ve often remarked, “If God meant for me to be cold, I’d have more fur!”

Quote Of The Week…

I’m going to share a quote and add one of my own.

“The idea that even the brightest person or group of bright people, much less the U.S. Congress, can wisely manage an economy has to be the height of arrogance and conceit.” — Walter E. Williams

“I’ve traveled throughout America, the cities, towns and villages where hard working people wish to raise their family without government intervention.

“I’ve traveled throughout America, the cities, towns and villages where hard working people wish to raise their family without government intervention.

America is still made up of strong, hardy, independent thinkers. We’ve survived numerous wars, civil war, depressions and out of control politicians. We have endured the stress and pain. We will go through tough times again and emerge stronger…not because of, but rather in spite of our government!” — Dennis Miller

And Finally…

Last week I spent several hours on the phone, making several calls, attempting to resolve a health insurance issue. When I hung up, a message from Jo popped up in my inbox. Sad to admit, there is way too much truth here!

Until next time…

Dennis Miller

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure – This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

[ad_2]

Source link

Most important is his investment recommendations. Richard offers sound logic behind his advice and is investing right along with us. I encourage our readers to click here and take advantage of his special offer.

Most important is his investment recommendations. Richard offers sound logic behind his advice and is investing right along with us. I encourage our readers to click here and take advantage of his special offer.