ECB Seen Delivering Two Half-Point Rate Hikes on Way to May Peak

(Bloomberg) — Back-to-back interest-rate increases of 50 basis points are approaching from the European Central Bank, whose battle with persistent inflation will see it hike borrowing costs until May, according to a Bloomberg survey of economists.

Most Read from Bloomberg

Respondents expect the deposit rate to then be held at 3.25% for about a year — until a souring economy brings about a series of quarter-point cuts, kicking off in June 2024.

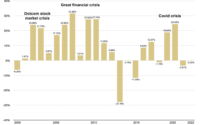

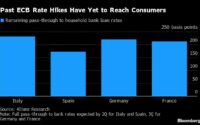

Despite 250 basis points of rate rises to date — the most aggressive monetary-tightening drive in ECB history — more than half of the analysts reckon officials are still behind the curve in tackling the euro zone’s worst-ever spike in prices. Only a third worry that policymakers will go too far.

The first ECB policy meeting of 2023 is next week and will almost certainly deliver the half-point hike that President Christine Lagarde promised in December. Beyond February, the survey results suggest officials won’t be inclined to ease off — even with inflation on the back foot, energy prices sinking and the Federal Reserve mulling a downshift in its own cycle of rate increases.

Lagarde and her hawkish colleagues are signaling an identical move is indeed likely in March — with money markets considering that the most likely outcome. Some members of the 26-strong Governing Council, however, say they’d prefer a more gradual approach. Four of 46 economists polled see only a quarter-point step that month.

“The focus at the February meeting will be on signals for the March meeting,” said Jussi Hiljanen, SEB’s head of European macro and fixed-income research. “The risk is that even a slight softening of the language could trigger an overly dovish interpretation by markets.”

Inflation may have dipped back into single digits but it remains much closer to 10% than to the ECB’s 2% target. Officials, meanwhile, are switching their focus to the underlying gauge that excludes food and energy costs and which hit a record in December.

“The biggest challenge for the Governing Council will be to balance the fact that headline inflation is now falling and might do so quite rapidly due to lower energy prices, with the fact that core inflation is still rising,” said Veronika Roharova, head of euro-area economics at Credit Suisse. For the ECB, “the latter will be more important.”

While the economy is faring better than feared late last year — thanks to the plunge in natural gas prices, government aid for households and business, and easing supply snarls — two-thirds of respondents still expect a recession. Estimates of the cumulative loss range from 0.3% to 1.4%.

But that won’t stop policymakers, who’ve long argued that any downturn will be shallow without meaningfully damping prices, from continuing to remove support.

What Bloomberg Economics Says

“If the main driver of the economic outlook in 2022 was the energy crisis, in 2023 it’s likely to be the ECB’s response to it. Higher projected interest rates mean we have revised down growth in the second half of 2023 — the biggest risk right now is that monetary policy has a greater impact on the economy than investors expect.”

— Jamie Rush and Maeva Cousin. For more click here

The ECB is set to reveal more details next week on plans to shrink its €5 trillion ($5.4 trillion) bond portfolio from March. The process will begin with officials allowing some debt to mature, rather than reinvesting the proceeds like they do now.

Economists predict that an initial cap on rolloffs — set at €15 billion a month through June — will rise by €5 billion in the third quarter and again around the turn of the year, holding steady at €25 billion through 2024. A third can envisage outright sales of bonds sometime in the future.

About three-quarters of respondents expect the ECB to reduce its stock of public-sector, corporate and covered bonds in proportion to its holdings. Four predict a focus on public-sector debt, while three see a preference for securities issued by the private sector.

Economists are split on whether the proceeds of maturing sovereign bonds will be reinvested in securities issued by that country, or across the region. The latter strategy is already in use for the ECB’s pandemic portfolio, allowing a more nimble response to bouts of market stress.

The ECB’s balance sheet is seen shrinking from just under €8 trillion currently to €6.9 trillion at year-end, €6.15 trillion in late-2024 and €5 trillion in the longer term.

–With assistance from Greg Ritchie and Zoe Schneeweiss.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]

Source link