Those Bankers! – Deflation.com

A sign of things to come as debt deflation takes hold.

All of a sudden, banks are in the spotlight. The collapse of Silvergate, the crypto bank, has coincided with a good-old fashioned bank run on Silicon Valley bank (SVB). The bank had accumulated heavy losses on its bond portfolio and finally, due to depositor outflows, took some of the hit. Cue concern, leading to worry, leading to panic from more depositors in SVB who mainly consist of venture capital-types who are not short of a bob or two (Brit speak for high net worth). Reverberations were seemingly being felt in financial markets this morning, with financial media on high-adrenalin excitement telling us that this has come out of the blue. For Elliott Wave International subscribers, though, it’s merely a forecast being fulfilled.

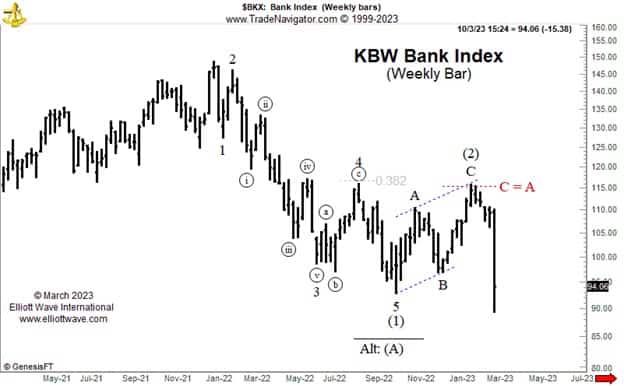

Back in October last year, we showed the chart below of the KBW Bank Index. Under the headline, “Boring Banks Bulging with Bonds Becoming a Bother,” we wrote about how banks were carrying heavy losses on their bond portfolios and that it was a problem that was not going to go away. Most importantly, we noted the very obvious five-wave decline in the index and stated:

“…it seems quite clear from an Elliott wave perspective that the bank sector will very likely continue to decline…”

Since then, the index has traced out a neat A-B-C correction, with wave C ending at the channel target, the level where it equaled wave A in percentage terms and at the extreme of the previous fourth wave. For Elliotticians, this chart really is a thing of beauty.

It seems very probable that another deep decline is underway. Targets include 72.20 and 45.15, where the coming decline will equal wave (1) or will be 1.618 times its length, in percentage terms.

If, as we suspect, major stock market indices are also going to decline, don’t be surprised if people start pointing blaming fingers at the banks again.

[ad_2]

Source link