Treasury Market Glitches Out As Liquidity Disappears; Fed Funds, SOFR Futures Halted

March 16, 2023

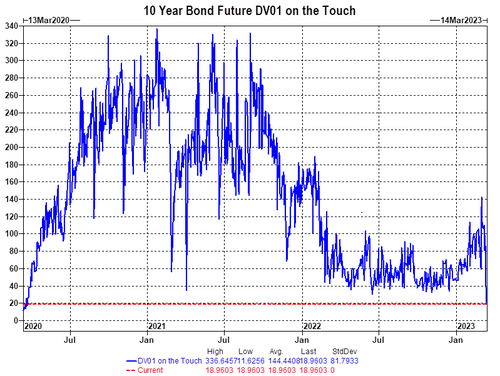

Last night, we shared with readers the latest views by Goldman flows guru who raised many alarms, but most notably perhaps his observations that Treasury market liquidity has completely vaporized, to wit: “10 year bond futures DV01 liquidity is 19K. This is the lowest since March 23rd, 2020 (Covid times). At the start of March 2023, you could trade 114k DV01 on the screens, and today is 19K, a decline in 83% month-to-date.”

Fast forward to this morning when we got the most vivid example of just how paralyzed what is – in theory – the “world’s most liquid bond market” when the yield on the 1M TBill swung from 4.2% to 3.6% back to 4.1% and then back down to 3.8%.

Loading…

[ad_2]

Source link