Gold Prices Set to Skyrocket

Chaos

Trying to fit a square peg into a round hole. Looking for in All the Wrong Places.

Could we have known at the time what headlines would emerge?

No. Yet what was apparent is that from central banks to sovereign spending and borrowing to geopolitics to anti-globalism to ongoing raw material issues and food shortages to rising global debt-nothing is as it was.

More headlines?

Here are a few:

Rates-While ECB raises .50-they also say they will cap at 4%

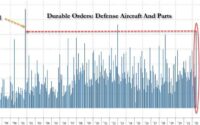

Banks–Regional Banks ETF looks lower still with SIVB filing Chapter 11

With $300 Billion added to the balance sheet-this is the opposite of QT-and signals a further lack of control

Banks borrowed $165 billion from the FED-more than in 2008

More on the US Dollar

Most concerning is if the drops (just fell from 114 in September to under 104 this past week), then what?

Will the rate matter at all in the fight against inflation?

And so, our top pick for 2023 was and still is .

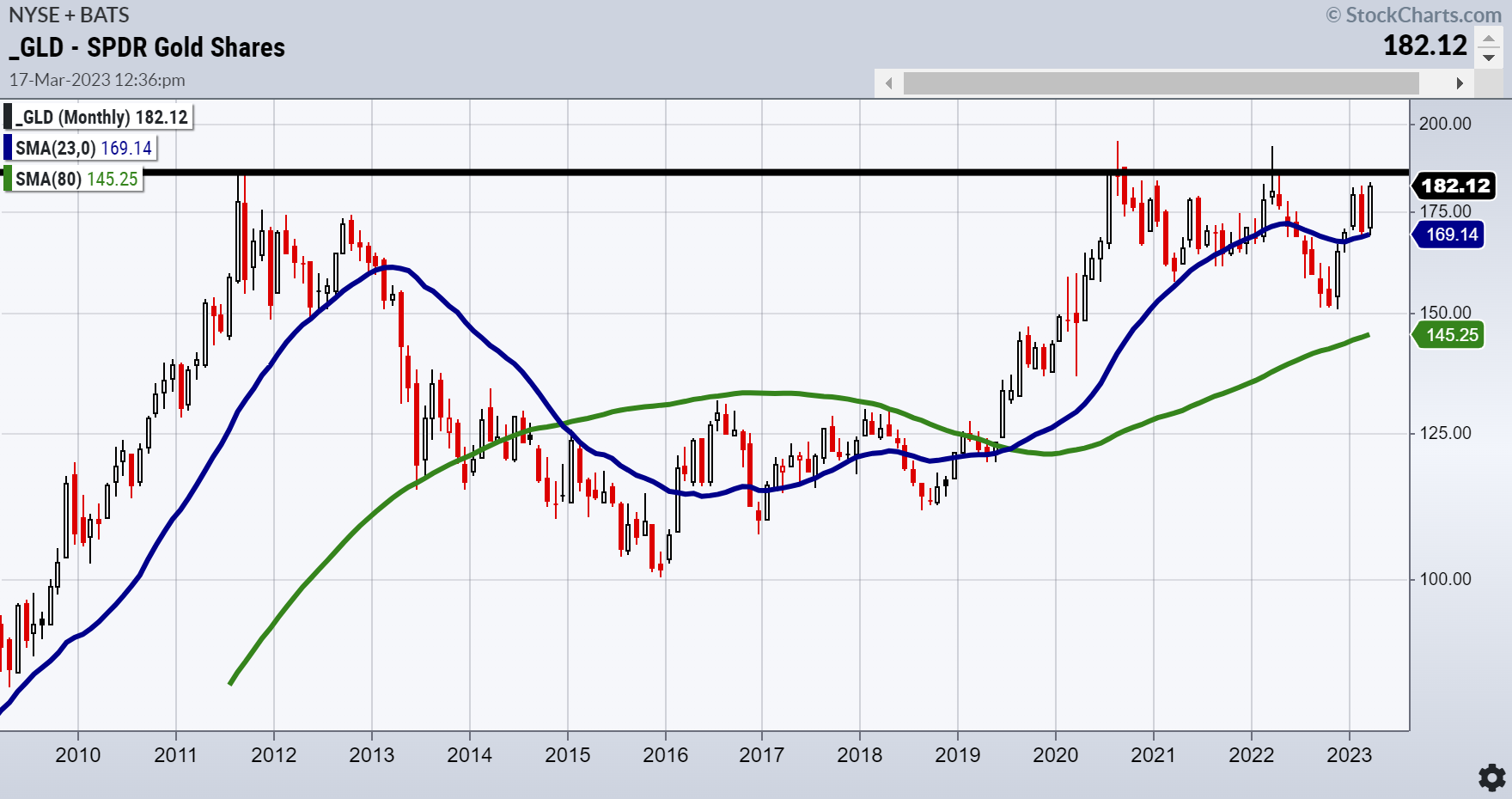

This is the monthly chart of gold as seen through the ETF GLD (NYSE:).

It dates to pre-2011, when gold was rising after the 2008 crisis. In August 2011, another huge headline hit the market:

S.& P. Downgrades Debt Rating of U.S. for the First Time

In August 2011, gold ran up to 184.82 before the political dance was resolved, and everyone played nice again.

Since the thick horizontal line stretched across the page to this month, GLD has not had a monthly close above those 2011 highs.

However, in August 2020, the GLD daily high was a short-lived pop to 194.45, yet GLD closed much lower later that month.

Technicians can see this chart in 2 ways.

First, triple or even quadruple tops around 184-185.

OR

A huge inverted 12-year head and shoulders bottom, which, if the neckline clears, measures the gold move to around 260.

Pretty much close to the 2023 call for gold to double or go to around $3000 an ounce. You decide which side of the T.A. call you want to be on.

However, watch the dollar as your best indicator. Under 104, inflation hits us in 2 ways. High cost of goods and lower purchasing power.

Of course, keep the chaos in your analysis, assuming we have yet to see all the ripple effects of recent headlines (not to mention China, Russia, and North Korea all persistently on the back burner).

Forget the Analysts, follow the Math

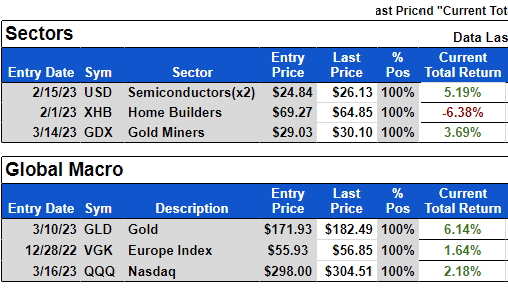

Sectors Table

MarketGauge’s GEMS Global Macro (Global Equities: Macro Sectors)

Current holdings based on M.G.’s proprietary indicators show GLD and gold miners GDX (NYSE:) in the portfolio.

Additionally, the model holds Nasdaq (NASDAQ:) and Semiconductors (NASDAQ:). Fascinating to see how the quants will resolve going forward.

ETF Summary

- S&P 500 (SPY) 390 pivotal and 380 support

- Russell 2000 (IWM) Still weak comparatively-170-180 range now

- Dow (DIA) 310 support 324 resistance

- Nasdaq (QQQ) 328 is the 23-month M.A. resistance-300 support

- Regional banks (KRE) 44 support 50 resistance-still looks like lower in store

- Semiconductors (SMH) 255.64, last month’s high. 248 nearest support

- Transportation (IYT) Clutch holds 218 and needs to clear 224 weekly close

- Biotechnology (IBB) Closed inside the prior week’s trading range

- Retail (XRT) 60 big support and 64 big resistance

[ad_2]

Source link