Watch Live: Fed Chair Powell Attempts High-Wire Walk Between Price & Financial System Stability

Having raised rates by 25bps (as expected) and offered a dovish bias to the statement with regard future rate-hikes, Fed Chair Powell now has the unenviable task of threading the needle between too-dovish (what does Powell know about just how bad the banking crisis really is…and what will that do to inflation) and too-hawkish (omfg, Powell’s going to kill the banks to crush inflation).

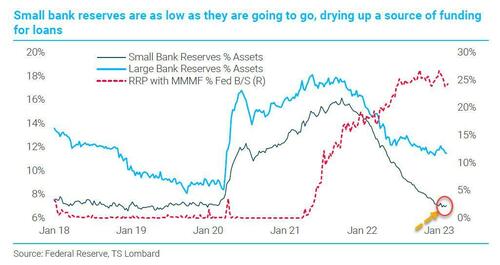

The goldilocks path, we are sure, will involve Powell using the words “we have the tools” and cajoling reporters along into believing that “the banking system is sound” – which of course ‘in aggregate’ it is, but the whole point is the massive decoupling between reserve rations of smaller banks and larger banks (and the contagion from the former on the economy and the rest of the banking system).

At the presser, Bloomberg looks for Powell to say interest-rate policy is the primary tool for achieving the Fed’s dual mandates of price stability and full employment, and shouldn’t be used as the first line of defense against threats to financial stability.

Powell will reject the idea that opening the Fed’s liquidity tool kit, and banks’ use of the discount window, represent an end to quantitative tightening.

Of course, he could just say f**k it!

LFG pic.twitter.com/hLbq2RPW1D

— Nick (🏆,🏆,🏆) (@NickatFP) March 22, 2023

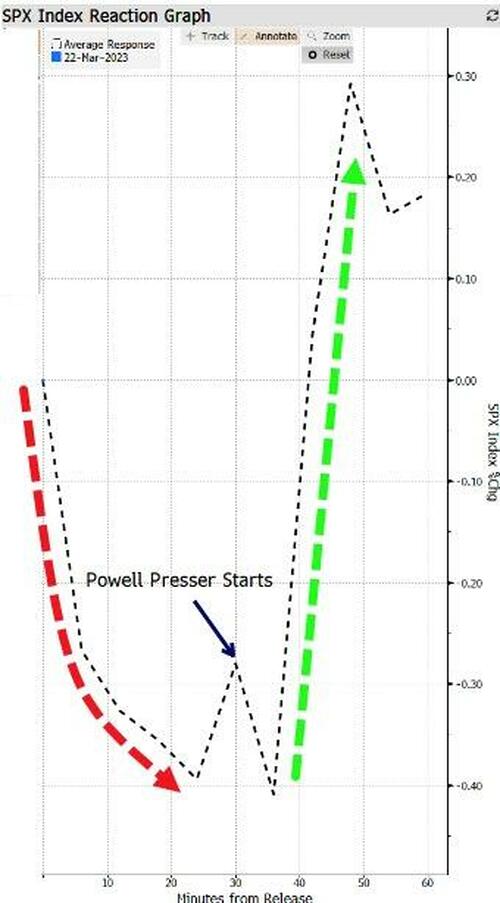

Keep in mind that it’s been a consistent pattern that stock markets tended to rebound soon after Powell speaks at press conferences.

Watch Powell walk the tight-rope live here (due to start at 1430ET):

Loading…

[ad_2]

Source link