Payments firm Block’s Australian shares slump after Hindenburg report By Reuters

[ad_1]

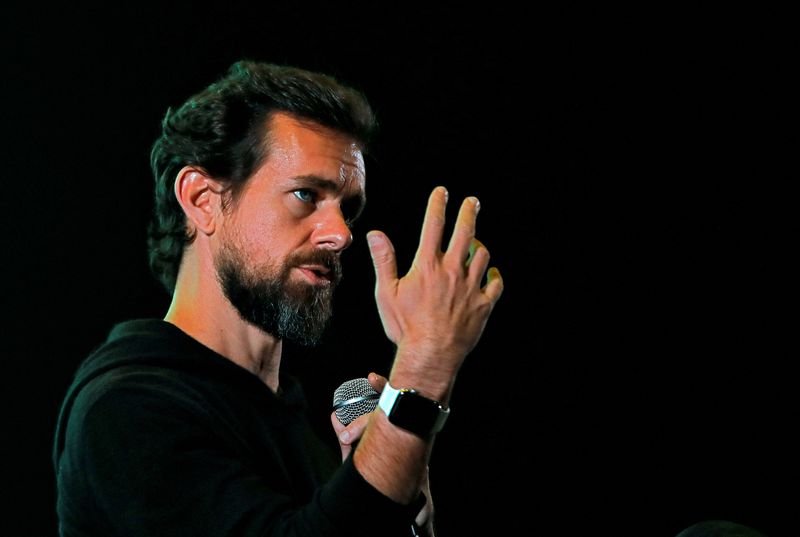

© Reuters. FILE PHOTO: Twitter CEO Jack Dorsey addresses students during a town hall at the Indian Institute of Technology (IIT) in New Delhi, India, November 12, 2018. REUTERS/Anushree Fadnavis/File Photo

By Navya Mittal

(Reuters) – Australia-listed shares of Block Inc, led by Twitter co-founder Jack Dorsey, plunged as much as 20% on Friday after Hindenburg Research alleged the payments firm overstated its user numbers and understated its customer acquisition costs.

Block said the report was “factually inaccurate and misleading” and that it was exploring legal action against the short-seller.

Shares of the San Francisco-headquartered company, which has a secondary listing in Australia, led losses in the country’s benchmark Index. They hit their lowest since November 2022 at A$86.30 before edging up slightly to $88.31.

Australia’s corporate watchdog, the Securities and Investment Commission, declined to comment. A source not authorised to speak with media said the matter was for U.S. regulators. The Australian Stock Exchange noted Block’s primary listing was in the U.S. and declined to comment further.

Block’s U.S. shares fell 15% on Thursday.

Hinderburg’s report, which was behind a market rout of more than $100 billion in India’s Adani Group earlier this year, said it found former Block employees estimated 40% to 75% of accounts they reviewed were fake, involved in fraud, or were additional accounts tied to a single individual.

The move is seen as a challenge to Dorsey, who co-founded Block in 2009 in his San Francisco apartment with a goal to shake up the credit card industry. He is the company’s largest shareholder with a stake of around 8%.

Investors have been in a “sell first, ask questions later” mode since the U.S. banking crisis “so this seems to be a well-timed attack by Hindenburg which puts Block on the chopping block,” said Matt Simpson, senior market analyst at City Index.

Block’s $29 billion buyout of the Australian buy-now-pay-later firm Afterpay “was designed in a way that avoided responsible lending rules in its native Australia,” the U.S. short-seller said in its report.

“Hindenburg’s attack on Block will be very closely watched by both regulators and investors, given the current banking turmoil has severely disrupted market sentiment,” said Glenn Yin, head of research and analysis, AETOS Capital Group

Markets will take time to digest the claims made under the short-seller’s two-year investigation, Yin added.

Graphic: Block Shares Tumble https://fingfx.thomsonreuters.com/gfx/mkt/gdpzqkbkdvw/Block%203.png

[ad_2]

Source link

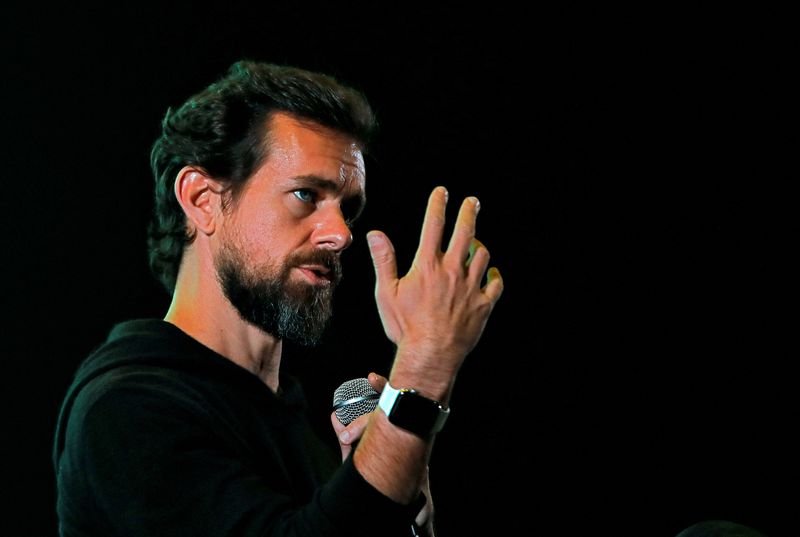

© Reuters. FILE PHOTO: Twitter CEO Jack Dorsey addresses students during a town hall at the Indian Institute of Technology (IIT) in New Delhi, India, November 12, 2018. REUTERS/Anushree Fadnavis/File Photo

By Navya Mittal

(Reuters) – Australia-listed shares of Block Inc, led by Twitter co-founder Jack Dorsey, plunged as much as 20% on Friday after Hindenburg Research alleged the payments firm overstated its user numbers and understated its customer acquisition costs.

Block said the report was “factually inaccurate and misleading” and that it was exploring legal action against the short-seller.

Shares of the San Francisco-headquartered company, which has a secondary listing in Australia, led losses in the country’s benchmark Index. They hit their lowest since November 2022 at A$86.30 before edging up slightly to $88.31.

Australia’s corporate watchdog, the Securities and Investment Commission, declined to comment. A source not authorised to speak with media said the matter was for U.S. regulators. The Australian Stock Exchange noted Block’s primary listing was in the U.S. and declined to comment further.

Block’s U.S. shares fell 15% on Thursday.

Hinderburg’s report, which was behind a market rout of more than $100 billion in India’s Adani Group earlier this year, said it found former Block employees estimated 40% to 75% of accounts they reviewed were fake, involved in fraud, or were additional accounts tied to a single individual.

The move is seen as a challenge to Dorsey, who co-founded Block in 2009 in his San Francisco apartment with a goal to shake up the credit card industry. He is the company’s largest shareholder with a stake of around 8%.

Investors have been in a “sell first, ask questions later” mode since the U.S. banking crisis “so this seems to be a well-timed attack by Hindenburg which puts Block on the chopping block,” said Matt Simpson, senior market analyst at City Index.

Block’s $29 billion buyout of the Australian buy-now-pay-later firm Afterpay “was designed in a way that avoided responsible lending rules in its native Australia,” the U.S. short-seller said in its report.

“Hindenburg’s attack on Block will be very closely watched by both regulators and investors, given the current banking turmoil has severely disrupted market sentiment,” said Glenn Yin, head of research and analysis, AETOS Capital Group

Markets will take time to digest the claims made under the short-seller’s two-year investigation, Yin added.

Graphic: Block Shares Tumble https://fingfx.thomsonreuters.com/gfx/mkt/gdpzqkbkdvw/Block%203.png