“Delay Your Home Purchase” – Bob Shiller Warns As Prices Slide For 7th Straight Month

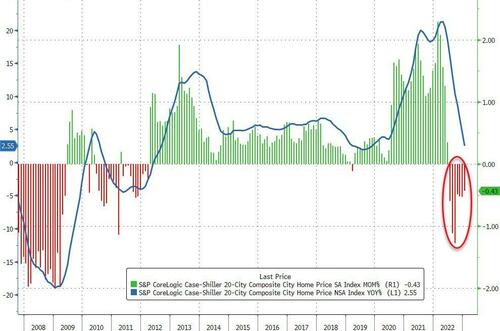

US home prices, according to S&P CoreLogic’s Case-Shiller index, fell for the 7th straight month (-0.42% MoM) leaving the home price index up 2.55% YoY (in January – this data is always very lagged) – the lowest growth since Nov 2019.

Source: Bloomberg

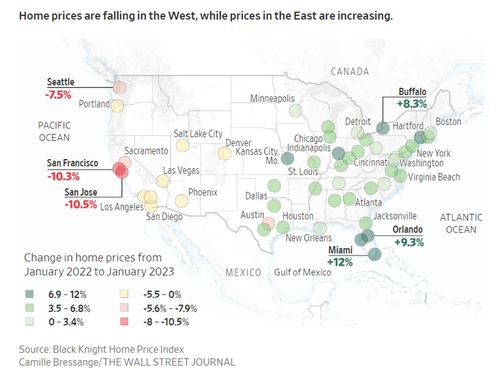

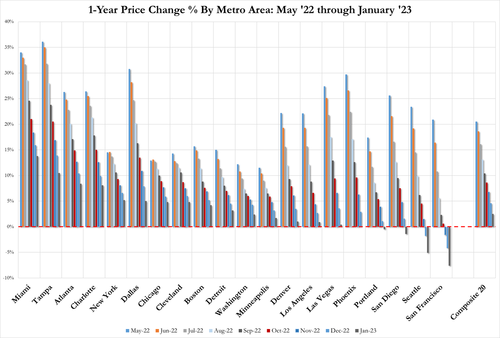

“One of the most interesting aspects of January’s report is the continued weakness in home prices on the West Coast, as San Diego and Portland joined San Francisco and Seattle in negative year-over-year territory,” Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

“It’s therefore unsurprising that the Southeast (+10.2%) continues as the country’s strongest region, while the West (-1.5%) continues as the weakest.“

Source: Bloomberg

San Francisco and Seattle are down the most from their highs (New York and Miami are down the least). Home prices in Miami and Tampa are still up over 60% since COVID…

Finally, the man behind the home price index – Yale economist Bob Shiller – told CNBC’s “Closing Bell: Overtime” Monday. “Home prices are very, very high by historical standards.”

“I would extrapolate the downturn somewhat – it’s going to continue,” he added.

“Maybe if you have a good chance to delay your purchase, it might be a good time to do it.”

“It might get a little cheaper after another six months.”

We suspect that is what Powell is hoping for, and judging by mortgage rates, prices have a long way to fall…

Unless The Fed folds.

Loading…

[ad_2]

Source link