New York

CNN

—

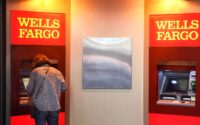

During Thursday’s meeting with the CEOs of large banks, Treasury Secretary Janet Yellen told executives that more bank mergers may be necessary as the industry continues to navigate through a crisis, two people familiar with the matter told CNN.

The comments from Yellen provide further evidence that Biden officials are starting to warm up to the idea of bank mergers despite concerns from progressives and the administration’s own scrutiny of corporate concentration.

The worst banking crisis since 2008, marked by a series of bank failures, plunging stock prices and concern about the business model of regional and mid-size banks, has forced a regulatory rethink. Regulators, of course, prefer corporate mergers where strong banks take over weaker ones over destabilizing bank failures.

“Consolidation is inevitable,” said Ed Mills, Washington policy analyst at Raymond James. “The progressive backlash is the Catch-22.”

Against this backdrop, Yellen met in Washington on Thursday with JPMorgan Chase CEO Jamie Dimon, Citigroup CEO Jane Fraser and other board members of the Bank Policy Institute.

The readout provided by the Treasury Department following that meeting noted that Yellen addressed the banking stress, reaffirming the “strength and soundness of the US banking system” and thanking the bankers for “their leadership and support.” But that readout did not mention discussion of bank mergers.

However, sources tell CNN that bank mergers were discussed during Yellen’s meeting with bank CEOs.

Yellen echoed remarks from US regulators who have said there may be bank mergers in the current environment, one person familiar with the matter said.

Yellen also expressed confidence that the nation’s diverse banking system, which includes institutions of many sizes, is on a solid foundation in the wake of recent events, the source said.

The Biden administration has sought to crack down on corporate concentration, with regulators moving to block JetBlue’s takeover of Spirit, Microsoft’s $69 billion acquisition of video game publisher Activision Blizzard and other major mergers.

Yet earlier this month, regulators allowed JPMorgan Chase, the nation’s largest bank, to buy most of First Republic, the second-largest bank to fail in US history. That deal, which came after a competitive bidding process and was aimed at stabilizing the system, drew sharp criticism from some progressives.

“What happened here is because a bank was under-regulated and started to fail, the federal government has helped JPMorgan Chase get even bigger,” Massachusetts Democratic Sen. Elizabeth Warren told CNN. “It may look good today while everything’s flying high, but ultimately if one of those giant banks, JPMorgan Chase, starts to stumble, the American taxpayers are the ones who will be on the line.”

Responding to CNN’s report on Friday, Dennis Kelleher, co-founder of financial reform advocacy group Better Markets, expressed concern about more bank consolidation.

“No mergers should be allowed that result in making the too-big-to-fail problem worse. That only sows the seeds for the next crisis, which will likely be much worse,” Kelleher told CNN.

During an interview with Reuters this week, Yellen said a certain degree of consolidation in the regional and mid-size banking sector could occur.

“This might be an environment in which we’re going to see more mergers, and you know, that’s something I think the regulators will be open to, if it occurs,” Yellen told Reuters.

Michael Hsu, acting comptroller of the currency, told lawmakers earlier this week that his agency would be willing to quickly consider bank mergers.

The Office of the Comptroller of the Currency is “committed to being open-mind when considering merger proposals and to acting in a timely manner on applications,” Hsu told the Senate Banking Committee.

Mills, the Raymond James analyst, said investors have shied away from the regional banking sector due to concerns about potential new regulation, surging deposit costs and the fact that shareholders were wiped out after recent bank failures.

“Nobody wants to be a hero,” said Mills. “With little to no warning, some banks went from some of the better-viewed lenders in the industry to zeros. That has spooked investors quite a bit.”