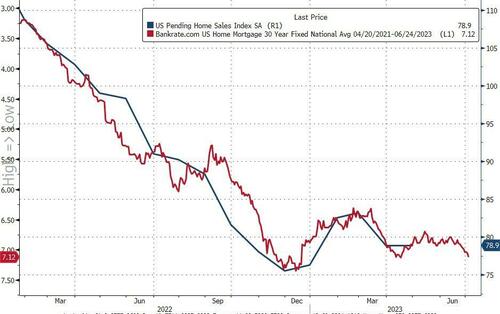

Pending Home Sales Disappoints In April As Mortgage Rates Top 7.00%

Existing home sales slumped in April while new home sales soared (thanks to heavy incentives and price cuts) and this morning’s pending home sales data was expected to rebound modestly after a sizable decline in March. However, pending home sales in April disappointed, unchanged from March and down 22.6% YoY…

Source: Bloomberg

Of course, as always NAR blames a lack of supply.. but does actually admit affordability is an issue

“Not all buying interests are being completed due to limited inventory,” Lawrence Yun, NAR chief economist, said in a statement.

“Affordability challenges certainly remain and continue to hold back contract signings, but a sizeable increase in housing inventory will be critical to get more Americans moving.”

Faltering sales in the Northeast offset small increases in the rest of the country.

So is the housing market good, bad, or ugly?

Source: Bloomberg

The pending home sales report is often seen as a leading indicator of existing-home sales given houses typically go under contract a month or two before they’re sold.

And finally, with mortgage rates back above 7.00%, don’t expect this ‘revival’ in demand to hold for long…

Source: Bloomberg

And Powell’s clear ‘pause’ signaling means ‘high rates for long’ unless we get a recession… neither of which are good for housing.

Loading…

[ad_2]

Source link