Gold slips as yields gain after US payrolls rise

(Reuters) – Gold slipped on Friday as hotter-than-expected U.S. jobs data lifted Treasury yields, but was on track for a weekly gain as a higher unemployment reading kept alive hopes that the Federal Reserve would pause interest rate hikes.

Spot gold was down 1.4% at $1,951.13 per ounce by 14:17 EDT (1817 GMT), after hitting a seven-session high earlier. U.S. gold futures settled 1.3% higher at $1,969.6.

Bullion has gained 0.2% so far this week, and is set to break a three-week losing streak.

U.S. nonfarm payrolls grew by 339,000 in May, beating expectations for an increase of 190,000, but the unemployment rate rose to 3.7% from a 53-year low of 3.4% in April.

Benchmark 10-year Treasury yields rose, and the dollar ticked up, making the greenback-priced, zero-interest-bearing bullion less attractive. [US/]

“The fact that the data is a little mixed is going to cancel itself out where the Fed most likely will look through that data and follow through with whatever they were planning on doing, which right now seems to be a pause,” said Everett Millman, chief market analyst at Gainesville Coins.

Traders priced in a 70% chance that Fed policymakers will leave rates unchanged later this month.

Philadelphia Fed chief Patrick Harker said on Thursday U.S. central bankers should not raise interest rates at their next meeting.

Higher rates increase the opportunity cost of holding bullion.

“This optimism around interest rates has offset any potential losses for gold now that the U.S. has reached agreement on its debt ceiling and avoided defaulting,” Kinesis Money analyst Rupert Rowling wrote in a note.

The U.S. Senate on Thursday passed a bipartisan legislation backed by President Joe Biden to lift the country’s debt ceiling.

Spot silver, also set to gain for the week, fell 1.2% to $23.62 per ounce.

Platinum fell 0.7% to $999.15 and palladium advanced 0.8% to $1,405.90, both set for weekly losses.

Reporting by Deep Vakil in Bengaluru; Editing by Vinay Dwivedi and Shilpi Majumdar

[ad_2]

Source link

Related Posts

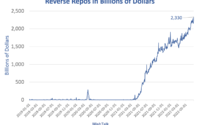

Reverse Repos Hit a New Record High of $2.33 Trillion: Plus a Q&A on Free Money! – Mish Talk

Larry Fink raises spectre of ‘slow rolling crisis’ after SVB failure