Gold marginally higher as investors remain wary of inconclusive outlook

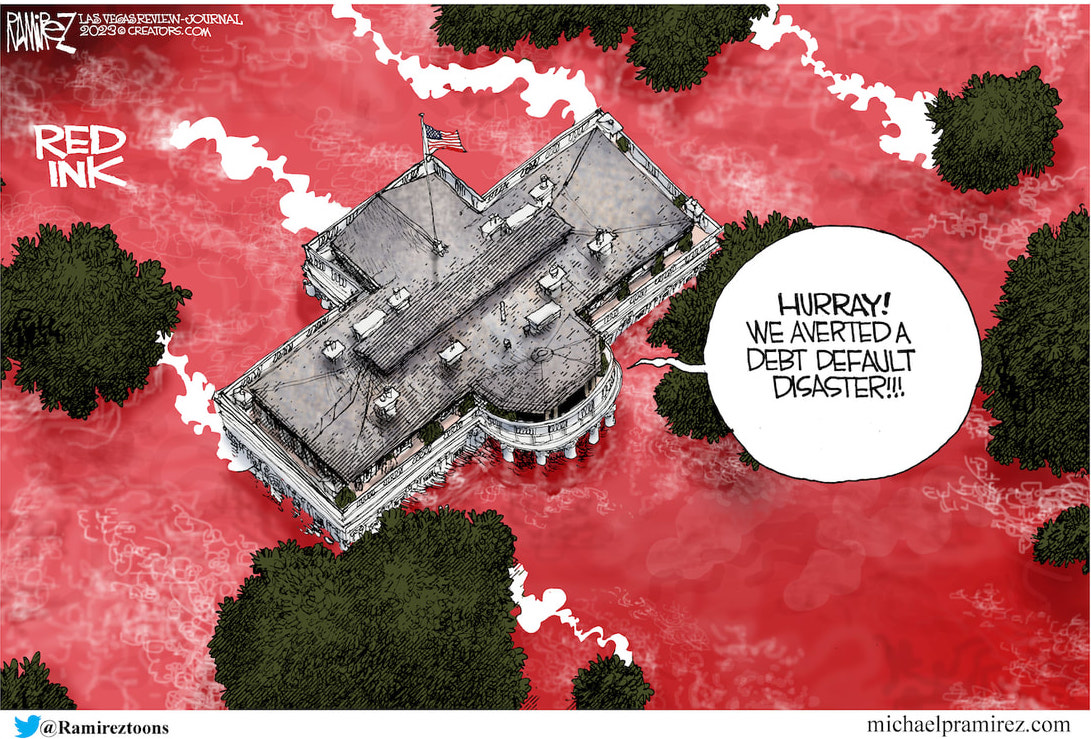

$1.1 trillion+ Treasury debt release muddies financial outlook

(USAGOLD – 6-6-2023) – Gold is marginally higher in early trading as investors remain wary of an inconclusive economic and financial picture. It is up $2.50 at $1966.50. Silver is up 11¢ at $23.71. One of the components of that muddied outlook is the expected $1 trillion+ tsunami of federal borrowing the Treasury Department is expected to unleash by the end of August. Many Wall Streeters are worried about the threat it imposes on the financial system. “This is a very big liquidity drain,” JP Morgan’s Nikolaos Panigirtzoglou told Bloomberg. “We have rarely seen something like that. It’s only in severe crashes like the Lehman crisis where you see something like that contraction.”

“Since the early 1970s, the logic for gold ownership has been inextricably bound to the cash flow problems of the federal government. As the national debt increased so did the well-documented damage associated with it – to the dollar, to financial markets and to the economy in general. Simultaneously, gold’s role as an inversely correlated portfolio hedge grew over that nearly one-half century as well.” – The National Debt and Gold: Here’s why the two have risen together since the 1970s and why the correlation is likely to continue

Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com