Gold Revaluation: Are the ECB and Fed Playing Chicken Now?

Authored by GoldFix ZH Edit

Macro analysts now see Gold and the changes gripping societal money on their radar and are writing about it. Sunday we synopsized a good one: Goehring & Rozencwajg’s Gold Commentary.

Yesterday we read AOTH’s Gold revaluation & the hidden motive behind central banks’ gold buying by Richard Mills. It also was good. It is quite detailed in that the author fleshes out the European logistics involving a potential Gold revaluation. Several have noted G7 Central Banker unity has frayed this past year and therefore we cannot help but think the GRA discussion will become a monetary game of chicken between the ECB and the US Fed.

We humbly suggest reading our 500 word summary below, then the original for more detail.

- Introduction

- Shift in Attitude

- De-Dollarization

- Gold as a Buffer for Losses

- Potential Use of GRA

- Implications for the Banking System

- Conclusion

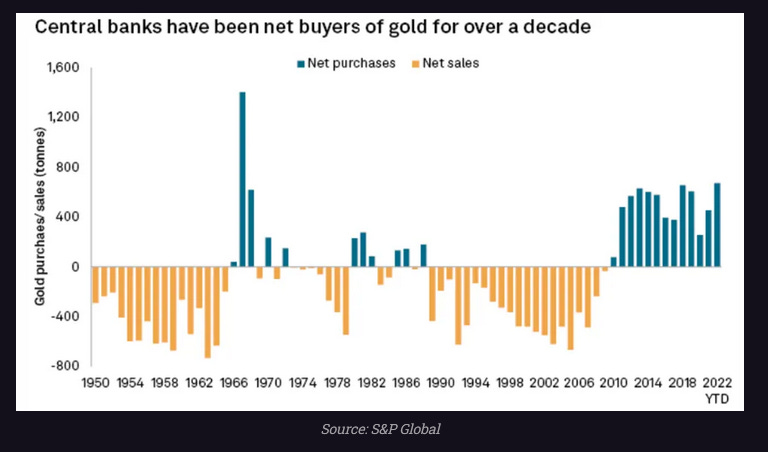

Central banks worldwide have been increasing their gold purchases, with a record-breaking 228 tonnes bought in the first quarter of this year alone. This trend follows a year of exceptional gold purchases in 2022, indicating a significant shift in central banks’ historical attitude towards the precious metal.

The motivations behind this gold buying spree go beyond the traditional reasons of hedging against economic turmoil and diversifying away from currencies and bonds. This article explores the evolving motives behind central banks’ gold purchases and the potential impact on their balance sheets.

Historically, central banks were net sellers of gold. However, since the 2007-08 financial crisis, central banks have become net buyers, with approximately 80% of central banks currently holding gold as part of their international reserves. The change in attitude can be attributed to the metal’s perceived value as a safe haven asset and its ability to protect against geopolitical risks and inflation.

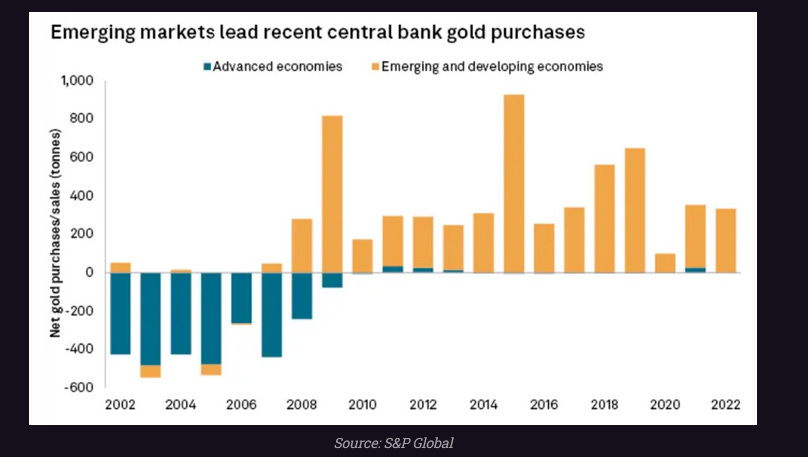

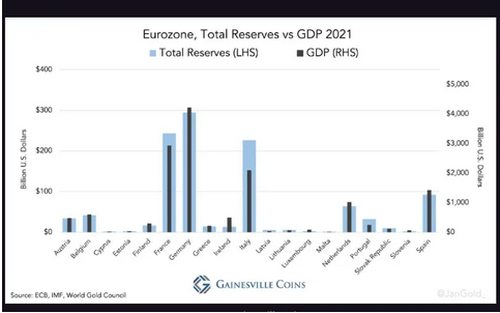

Emerging market and developing economies, including Russia and China, have been at the forefront of gold buying, accounting for about half of the total tonnage bought over the past two decades. With regard to the ECB and Fed we wonder, does it behoove the EU to revalue before the US gives the go ahead? Perhaps the ECB is waiting for that to prevent what could be increased antagonism between the institutions. Hard to say right now.

These countries aim to diversify their reserves away from the US dollar and protect against foreign seizures and potential Western sanctions. Gold enables them to replace the USD and circumvent financial restrictions when conducting international trade.

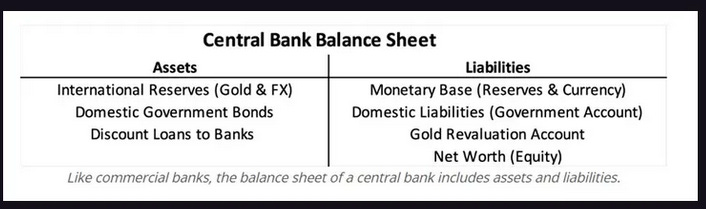

One of the driving forces behind the increased gold purchases may be the desire of central banks to use the unrealized gains from gold holdings to write off sovereign bonds and cover losses. The significant rise in gold prices has resulted in central banks holding unrealized gains worth hundreds of billions of dollars.

By leveraging these gains, central banks can reduce their debt burdens and provide relief to their respective governments. Gold revaluation accounts (GRAs) offer a potential mechanism for recording these unrealized gains on central banks’ balance sheets.

GRAs function as a way to account for unrealized gains in gold on a central bank’s balance sheet. These gains can be used to balance out the increase in gold’s value and inflate the bank’s balance sheet.

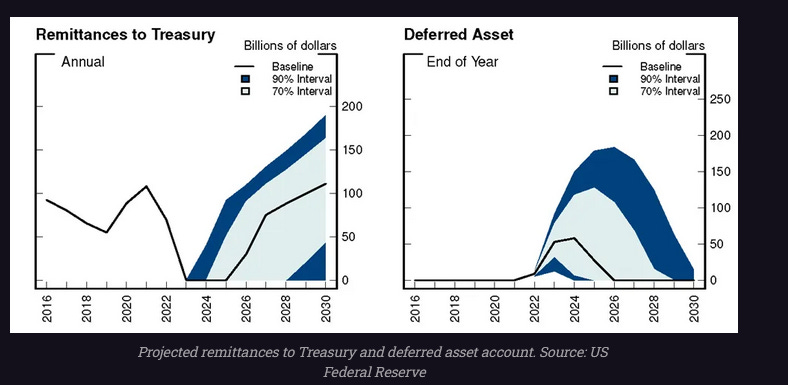

While European Union regulations currently prohibit the use of GRAs, some European central banks, including the Dutch and German central banks, have hinted at the possibility of leveraging these accounts to address solvency issues. However, the US Federal Reserve faces challenges in revaluing gold due to its implications for the dollar’s reserve currency status.

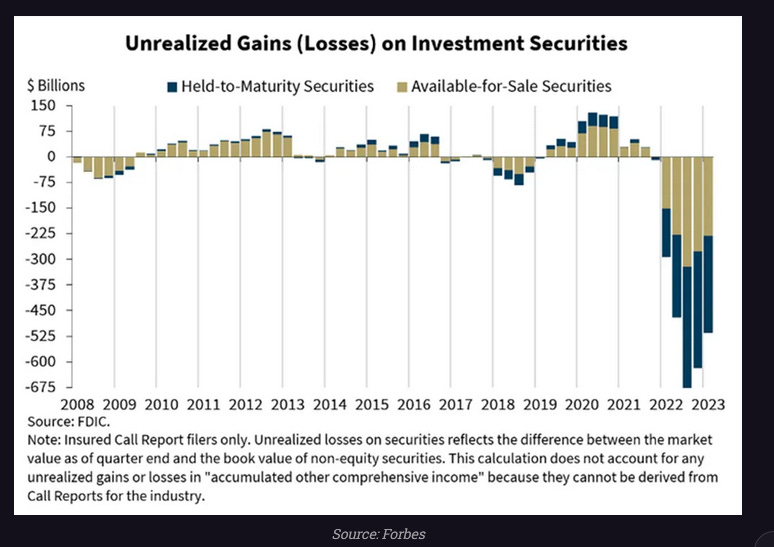

The US banking system is facing significant risks, with unrecognized losses on bank balance sheets estimated to be as high as $1.7 trillion. Central banks play a crucial role as the lender of last resort, and their balance sheets would be affected by these losses.

The US Federal Reserve’s ability to address these losses is limited, given the potential negative impact on the dollar. A revaluation of gold could offer a solution, but it presents challenges and requires careful balancing of assets and liabilities on the central bank’s balance sheet.

Central banks’ increased gold purchases signify a paradigm shift in their attitude towards the metal. The motives behind these purchases extend beyond traditional reasons, such as hedging against economic turmoil and diversification.

Emerging market economies seek to reduce reliance on the US dollar and protect against financial restrictions, while central banks may consider leveraging gold’s unrealized gains to write off sovereign debt.

The use of gold revaluation accounts provides a potential mechanism for accounting for these gains. However, the implications for the banking system, particularly the US Federal Reserve, present challenges that need to be carefully navigated.

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

Loading…

[ad_2]

Source link