The weaponization of finance threatens the future of the dollar standard

Powerful countries that bully weaker ones and target non-combatants are bound to invite a strong response. In the context of the ongoing war in Ukraine, any direct Western military action can essentially be ruled out. (The Cold War concept of Mutual Assured Destruction (MAD) is still in play if it involves a direct conflict with Russia.) This has led many to call for wide-ranging financial sanctions and restrictions to be imposed on Russia.

The decision to remove several Russian banks from the SWIFT financial messaging system and sanction the country’s central bank has been popular among the general public but has raised concerns on Wall Street. Further sanctions on Russian commodity exports might roil the global market and further fuel the inflationary dynamics that have caused food and energy prices to skyrocket in recent months. Potentially destabilizing consequences for the emerging and developing world cannot be ruled out.

Given the heated global political environment, it is necessary to inject a note of caution into ongoing debates centered on the weaponization of dollar-based global finance. If we take a step back and calmly evaluate the potential long-term strategic and economic threats facing the U.S., one in particular stands out. Ever since the U.S. dollar replaced the UK’s pound sterling as the global reserve currency, America has come to depend on its “exorbitant privilege” to a considerable degree.

The dollar’s pre-eminent status as the world’s reserve currency ensures that there is a strong and persistent demand for dollar-denominated assets worldwide. It also enables the U.S. to run persistent trade and current account deficits. Furthermore, the desire among foreign central banks and private parties to hold U.S. Treasuries is to a large extent dependent on the dollar’s critical role in the international financial system. It has also allowed U.S. policymakers to pursue profligate fiscal policies for decades without having to face significant market discipline.

Back in 1960, Belgian-born economist Robert Triffin highlighted an inherent dilemma that arose from having an international monetary system that was centered on a national sovereign currency (the U.S. dollar). According to the eponymously-named Triffin Dilemma, the U.S., as the reserve-issuing country, needs to run persistent balance of payments (BOP) deficits in order to satisfy the ever increasing demand for liquidity that is generated by a growing world economy. Yet, the very act of running persistent BOP deficits will ultimately undermine global confidence in the U.S. dollar.

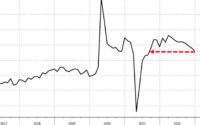

The pandemic shock had already raised concerns about the future of the U.S. dollar-centric global monetary order. The dramatic expansion of the Fed’s balance sheet and the explosive growth in public debt levels have led some to fear potential fiscal dominance of monetary policy in the years ahead. Furthermore, as stimulus-fueled spending patterns shifted from services to goods, the U.S. ran up a sizable trade deficit with China over the past couple of years.

Now, faced with the distinct possibility of the emergence of a China-Russia economic and strategic partnership, we may be entering a new phase that involves a geopolitical contest for global influence across multiple spheres. China has been open about its long-run desire to supplant the U.S. dollar-centric post-WWII global monetary order. Given recent geopolitical developments, the renminbi internationalization agenda will likely regain momentum.

China’s push to establish a digital yuan and create an alternate payments system is part of the plan. The massive Belt-and-Road Initiative (BRI) will also aid China in its attempts to broaden international acceptance and usage of its currency. Back in 2020, given already rising geopolitical tensions, China and Russia agreed to ditch the U.S. dollar for bilateral trade settlements.

From an American perspective, there is still the hope that Chinese leader Xi Jinping’s increasingly inward-looking policies may limit the attractiveness of Chinese currency and assets, and slowdown the pace of renminbi internationalization. Any genuine moves to increase the global acceptance of the renminbi/digital yuan will require China to fully open its capital markets to foreigners. But such a step may not be in accordance with Xi’s dual-circulation economic strategy.

Recent moves by the West to weaponize dollar-based global finance may yet provide the necessary spur for China to speed up measures to reduce its reliance on the U.S. dollar and create an alternate global financial payments system. Furthermore, given China’s increasingly aggressive stance towards Taiwan, a future flare-up with the U.S. cannot be ruled out.

If, for instance, the U.S. were to abandon its stance of “strategic ambiguity” in regards to defending Taiwan, China is likely to respond militarily. Having observed the West’s reaction to Russian aggression, China will rationally conclude that any significant exposure to the SWIFT network and the dollar-based global financial system will curtail its options.

Some techno-libertarians still dream of replacing the U.S. dollar-based global monetary order with a non-sovereign, cryptocurrency-based regime. Frankly, given the centrality of seigniorage and the immense strategic significance associated with having a U.S. dollar-centric global monetary order, it is quite unlikely that American authorities will ever truly allow a crypto-based non-sovereign system to threaten the current regime.

Given the emergence of the China-Russia alliance, and, considering China’s continuing rise as an economic and military power, we cannot underestimate the future risk to the U.S. dollar’s global status. Strengthening U.S. alliances with emerging powers (like India and Brazil) and establishing closer ties with the African continent will be essential for the West as we enter a new era of geopolitical competition.

Vivekanand Jayakumar is an associate professor of economics at the University of Tampa.

[ad_2]

Source link