December Payrolls Beat Expectations But Wage Growth Disappoints, Lowest Since August 2021

There was a general sense of foreboding ahead of today’s jobs report, because as we wrote in our payrolls preview, several strategists noted that there was virtually no number that would be good for risk assets. As Goldman trader John Flood said, “whispers into December’s jobs print are creeping higher as we have already gotten 4 strong labor data points this week… We are still in a good data is bad for stocks set up but the new spin is that really bad data is also bad for stocks. AKA risk is skewed to the downside.” Meanwhile Bloomberg’s Heather Burke writes that the “median estimate for the change in non-farm payrolls is 202k versus a prior 263k and for the unemployment rate to stay steady at 3.7%. But the Fed’s own estimate is for the unemployment rate to shoot up to 4.6% this year. Until we get there, there is not going to be an alignment of demand with supply, which will compel the Fed to stay hawkish with no chance of a pivot.“

So with that in mind, here is what the BLS reported moments ago:

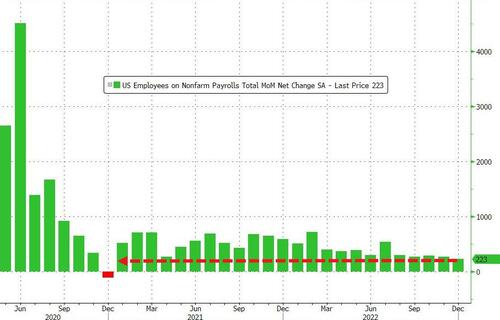

In December, payrolls rose 223K, which was down from last month’s downward revised 256K and also the lowest since the negative December 2020 print, but was above the consensus estimate of 202K.

This was a record 8th consecutive beat of expectations in a row!

If payrolls were stronger than expected, the unemployment was especially hot, sliding from a downward revised 3.6% (was 3.7% previously) to 3.5%, the lowest since September, even as the unemployment rate for Blacks and Hispanics did not drop, even as white unemployment hit a record low: among the major worker groups, the unemployment rate for Whites fell to a record low 3.0% while the jobless rates for adult men (3.1 percent), adult women (3.2 percent), teenagers (10.4 percent), Blacks (5.7 percent), Asians (2.4 percent), and Hispanics (4.1 percent) all showed little or no change over the month.

Of the -0.18% drop in the unemployment rate, the change in the number of unemployed contributed 0.31 ppts, while the change in the size of the labor force contributed -0.49 ppts…

… and indeed, the unemployment rate dropped even as the labor force participation rate actually ticked up.

The underemployment rate was also notably lower, sliding from 6.7% to 6.5%, a record low.

But the big surprise in today’s report was not in jobs but in wages, as the average hourly earnings rose just 0.3% M/M in December, down from 0.6% previously (revised to 0.4%) and below the 0.4% expected. Here is the breakdown by industry:

On an annual basis, hourly earnings rose just 4.6%, down from last month’s 5.1% (which was also revised sharply lower to 4.8%) and missing the consensus estimate of a 5.0% gain. This was the slowest wage growth since August 2021, and suggests that any potential wage-price spiral may have finally been broken by the Fed’s rate hikes.

Indeed, it It was this miss in wage growth that sparked a violent market repricing higher, and as Vanda’s Viraj Patel writes, “wage growth is transitory (note small miss on MoM = huge miss on YoY given base effects). Goldilocks jobs report… strong job gains, more job supply (uptick in participation). Doesn’t change the Fed trajectory here – softer wages gives them time to take hikes slowly $USD.”

⚠️ Wage growth is transitory (note small miss on MoM = huge miss on YoY given base effects). Goldilocks jobs report… strong job gains, more job supply (uptick in participation). Doesn’t change the Fed trajectory here – softer wages gives them time to take hikes slowly $USD pic.twitter.com/PJIFammn7W

— Viraj Patel (@VPatelFX) January 6, 2023

According to Bryce Doty, senior portfolio manager at Sit Investment Associates, “Fed Chair Powell should like what he sees in the jobs data given a moderating wage growth and uptick in worker participation rate… the key, though, is average hourly earnings coming in at a mild 0.3% increase along with a 0.2% revision downward to last month down to 0.4%. We expect a modest relief rally given this data easing some of the Fed’s concerns concern on the tight labor market.”

And another notable observation comes from Fed mouthpiece Nick Timiraos himself, who points out that “Revisions to average hourly earnings data paint a marginally less worrisome picture for the Fed on wages than the Nov report. The upturn in wage growth in Nov (originally reported as +0.6%) was revised (to +0.4%). The 4.6% annual wage growth in Dec was the lowest since Aug ’21.”

Revisions to average hourly earnings data paint a marginally less worrisome picture for the Fed on wages than the Nov report

The upturn in wage growth in Nov (originally reported as +0.6%) was revised (to +0.4%)

The 4.6% annual wage growth in Dec was the lowest since Aug ’21 pic.twitter.com/1lCjoDjcMe

— Nick Timiraos (@NickTimiraos) January 6, 2023

Some other details from the report:

- The number of long-term unemployed (those jobless for 27 weeks or more) declined by 146,000 to 1.1 million in December. This measure is down from 2.0 million a year earlier. The long- term unemployed accounted for 18.5 percent of all unemployed persons.

- The employment-population ratio increased by 0.2 percentage point over the month to 60.1 percent. The labor force participation rate was little changed at 62.3 percent. Both measures have shown little net change since early 2022. These measures are each 1.0 percentage point below their values in February 2020, prior to the coronavirus (COVID-19) pandemic.

- The number of persons employed part time for economic reasons, at 3.9 million, changed little in December. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs.

- The number of persons not in the labor force who currently want a job fell by 352,000 to 5.2 million in December and is little different from its February 2020 level of 5.1 million. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force declined by 231,000 to 1.3 million in December. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, numbered 410,000 in December, essentially unchanged from the previous month.

Drilling down into the BLS’s establishment survey we get the following ridiculous modeled “data”:

- Employment in leisure and hospitality rose by 67,000. Employment continued to trend up in food services and drinking places (+26,000); amusements, gambling, and recreation (+25,000); and accommodation (+10,000). Leisure and hospitality added an average of 79,000 jobs per month in 2022, substantially less than the average gain of 196,000 jobs per month in 2021. Employment in the industry remains below its pre-pandemic February 2020 level by 932,000, or 5.5 percent.

- Health care employment increased by 55,000 in December, with gains in ambulatory health care services (+30,000), hospitals (+16,000), and nursing and residential care facilities (+9,000). Job growth in health care averaged 49,000 per month in 2022, considerably above the 2021 average monthly gain of 9,000.

- Employment in construction increased by 28,000 in December, as specialty trade contractors added 17,000 jobs. Construction employment increased by an average of 19,000 per month in 2022, little different than the average of 16,000 per month in 2021.

- Social assistance added 20,000 jobs in December. Employment in individual and family services continued to trend up over the month (+10,000). Job growth in social assistance averaged 17,000 per month in 2022, compared with the 2021 average of 13,000 per month.

- Employment in the other services industry continued to trend up in December (+14,000). Monthly job growth in other services averaged 14,000 in 2022, lower than the average of 24,000 per month in 2021. Employment in other services is below its February 2020 level by 174,000, or 2.9 percent.

- In December, mining employment increased by 4,000, reflecting job growth in support activities for mining (+5,000). Since a recent low in February 2021, mining employment has grown by 104,000.

- Employment in retail trade changed little in December (+9,000). Job growth in retail trade averaged 16,000 per month in 2022, less than half the average growth of 35,000 per month in 2021.

- Over the month, employment in manufacturing changed little (+8,000), as job gains in durable goods (+24,000) were partially offset by losses in nondurable goods (-16,000). In 2022, manufacturing added an average of 32,000 jobs per month, little different than the average of 30,000 jobs per month in 2021.

- In December, employment in transportation and warehousing changed little (+5,000). Air transportation (+3,000) added jobs over the month, while employment continued to trend down in couriers and messengers (-4,000) and in warehousing and storage (-3,000). In 2022, average job growth in transportation and warehousing (+17,000) was about half the average job growth in 2021 (+36,000).

- In December, government employment was essentially unchanged (+3,000). Employment in state government education declined by 24,000, reflecting strike activity among university employees.

- Employment in professional and business services remained little changed in December (-6,000). Employment in temporary help services declined by 35,000 over the month and has fallen by 111,000 since July. Job growth in professional and business services averaged 50,000 per month in 2022, roughly half of the average of 94,000 per month in 2021.

And a visual breakdown:

Commenting on the report, some commentators and Fed mouthpieces – such as Nick Timiraos – noting that this was clearly a goldilocks report, as job growth continues but at a far slower pace of wage growth and “revisions to average hourly earnings data paint a marginally less worrisome picture for the Fed on wages than the Nov report”, or as Bloomberg economist Anna Wong notes:

“December’s nonfarm payroll report appears at first sight to be a Goldilocks print: An expanding labor force and robust hiring drove down the unemployment rate, but wage growth also moderated. The previous month’s jump in average hourly earnings — which so alarmed the Fed — has been revised away. The signal Bloomberg Economics takes from this report is that momentum in the labor market may have picked up again toward the end of last year. Given that information, together with what we know about early revisions to benchmark data, we expect two more 25-basis-point rate hikes by the Fed, with the terminal rate reaching 5% in March.”

… other Fed watchers countered that while “this looks like the right direction of travel re: jobs… it’s probably not *as much* of a slowdown as the Fed wants, yet. Chair Powell is looking for notable cooling in wages, and has quoted 100K as the no. of jobs needed to absorb pop growth.”

This looks like the right direction of travel re: jobs.

But it’s probably not *as much* of a slowdown as the Fed wants, yet. Chair Powell is looking for notable cooling in wages, and has quoted 100K as the no. of jobs needed to absorb pop growth

More:https://t.co/9Vpdkoijyg

— Jeanna Smialek (@jeannasmialek) January 6, 2023

What does today’s report mean in terms of future Fed hikes? Gere too, views are clearly divided — while CIBC sees a 50 basis-point hike next time, saying that the bottom line here for the Fed is this:

“Overall, this report is still consistent with the need for an additional 50 basis points from the Fed before a pause in the hiking cycle.”

… High Frequency Economics says the Fed could step down further to a 25 basis-point move. Here’s their chief US economist, Rubeela Farooqi:

“While job growth remains solid and the unemployment rate is low, a deceleration in wages in December and the downward revision to November will be welcome news and could support another step down to a 25 basis-point hike in February.”

What about no hikes? Well, according to Jeffrey Rosenberg, portfolio manager at BlackRock, whether the Fed can get away with a pause depends on inflation declining. He says a pause won’t happen if the Fed doesn’t achieve its inflation objective. He calls the report mixed and highlights the deflating goods side.

This puts a premium on Fed communication in coming days and weeks, ahead of the Feb. 1 rate decision. It will be interesting to see what Fed speakers themselves – and there are plenty later today – will say.

Loading…

[ad_2]

Source link