Is the $USD Warning That Inflation is About to Become BAD News For Stocks?

By Graham Summers, MBA

Yesterday,

I outlined how the markets are likely at a very critical point regarding inflation.

By

quick way of review:

1)

Stocks initially love inflation because it boosts results

(companies don’t report inflation-adjusted returns, so any increase in product

pricing due to inflation is instead reflected as “growth”).

2)

This love relationship eventually turns to hatred as inflation leads to higher

operating costs, which squeeze profit margins.

In

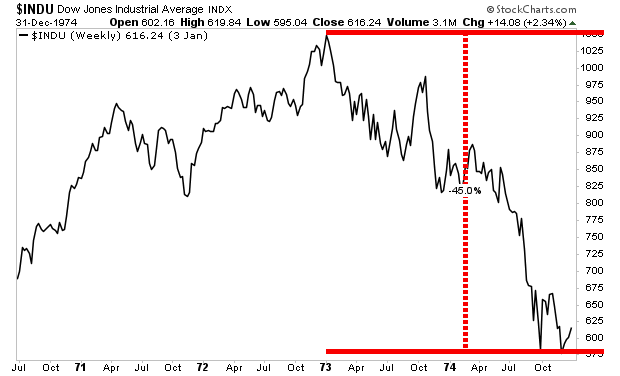

yesterday’s article, I illustrated how this played out during the last major

bout of inflation in the 1970s.

At that

time, stocks initially roared higher as inflation initially boosted corporate

results. However, by the time 1974 rolled around and inflation (as measured by

the consumer price index or CPI) hit 11%, stocks began to crash, eventually

losing ~50%.

I mention all of

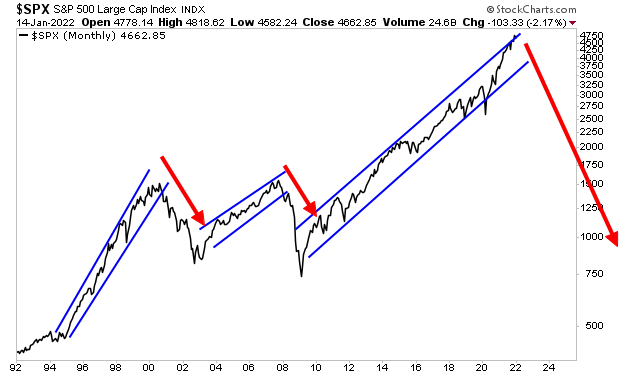

this because it is highly likely that something similar is about to manifest in

the markets today.

Stocks have erupted higher on the back

of inflation, courtesy of $11 trillion in Fed QE/ fiscal stimulus from the

Federal Government between March 2020 and today.

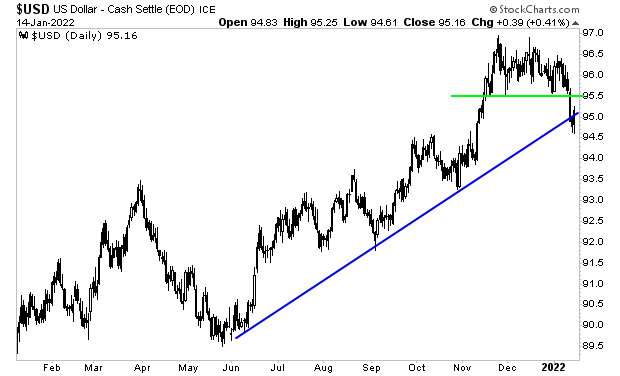

However, inflation is now taking a turn

for the worse. And, as usual, the signs are showing up in the currency markets

first.

The Fed is in the

process of ending its QE program. Fed officials have also signaled that they

intend to raise rates three or four times this year. All of this should be

highly U.S. dollar positive.

And yet… the $USD

is breaking down.

The greenback has

taken out key support (green line in the chart below). Even worse, it’s also

broken its bull market trendline (blue line in the chart below).

This is a MAJOR signal

that the Fed’s actions are not enough. Put another way, the Fed is behind

the curve on inflation! This is extremely negative for stocks as it means inflation

is getting out of control (just like in 1974).

So, what would a similar, 1970s-style crisis look like today? The market is warning us, though few have noticed.

For those looking to prepare and

profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which

investments will perform best during a market meltdown as well as how to take

out “Crash insurance” on your portfolio (these instruments returned TRIPLE

digit gains during 2008).

To pick up your copy of this report, FREE,

swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Related

[ad_2]

Source link