- U.S. 10-year bond yields hit near one-week high

- Dollar slides to more than two-week low

- Markets await U.S. non-farm payrolls data on Friday

Gold steadies as weaker dollar, stocks offset stronger yields

February 3, 2022

Feb 3 (Reuters) – Gold prices steadied on Thursday, as a weaker dollar and risk-off sentiment in the equity markets helped counteract pressure from a jump in U.S. Treasury yields.

Spot gold was flat at $1,806.07 an ounce, by 14:07 EST (1907 GMT). It had earlier fallen 1% to a session low of $1,787.70 due to a spike in U.S. Treasury yields on rising U.S. rate hike bets.

U.S. gold futures settled 0.3% lower at $1,804.10.

Register now for FREE unlimited access to Reuters.com

Register

The dollar index fell 0.7% to an over two-week low against its rivals, making gold less expensive for other currency holders. U.S. stock indexes dropped after Facebook outlook sparked a tech rout.

Benchmark 10-year note yields jumped to 1.838%, its highest in nearly a week after a hawkish rate hike by the Bank of England boosted investors expectations towards similar moves by the U.S. central bank. read more

Fed officials have signalled they will start raising interest rates next month to fight high inflation.

“Gold is once again being hit by the fact that central banks are gradually coming around to the idea that tightening is going to be warranted to get inflation under control,” said Craig Erlam, senior market analyst at OANDA.

“It’s clear the central bank is the latest to accept it underestimated the inflation problem and markets are now pricing in multiple hikes.”

Gold is highly sensitive to rising U.S. interest rates, as these increase the opportunity cost of holding non-yielding bullion.

Investors are now eyeing Friday’s closely watched U.S. non-farm payrolls report for January.

Gold could see a lift from a subdued U.S. jobs report, forcing markets to rethink how aggressive the Fed needs to be to tame inflation, said Extinity analyst Han Tan.

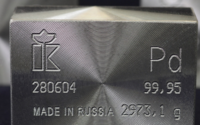

In other metals, silver declined 0.9% to $22.42 an ounce, platinum fell 0.2% to $1,031.06 and palladium dropped 1.9% to $2,325.62.

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Kavya Guduru and Brijesh Patel in Bengaluru; Editing by Krishna Chandra Eluri

Our Standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link