Visual Capitalist/Dorothy Neufeld/1-13-2022

“Here’s how it works:

-

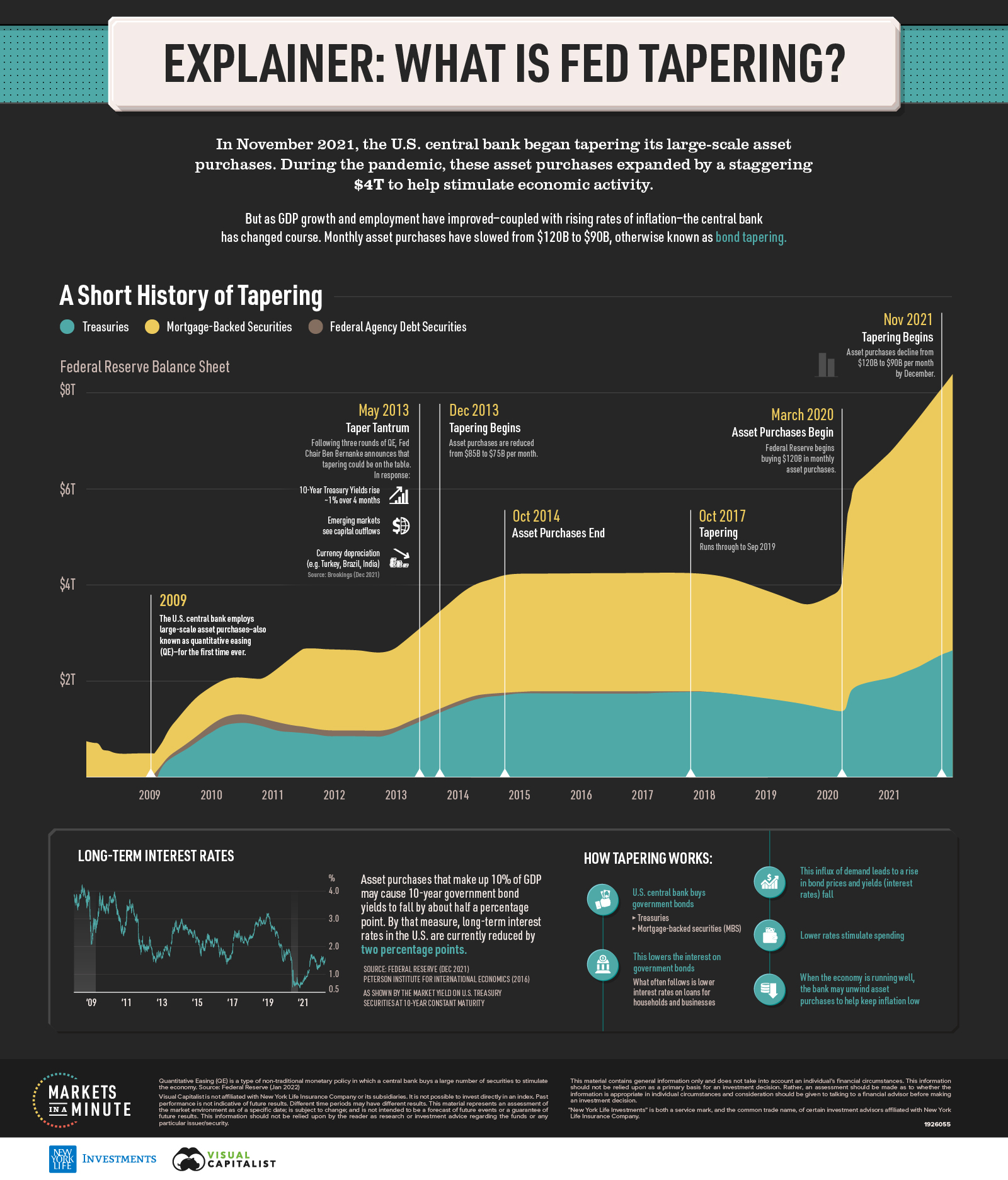

- The U.S. central bank buys government bonds typically in the form of Treasuries and mortgage-backed securities (MBS).

- This influx of demand leads to a rise in these bond prices and their yields (interest rates) fall.

- As this lowers the interest rate on the government bonds, what often follows is lower interest rates on loans for households and businesses.

- Lower rates stimulate spending.

- When the economy is running well, the bank may unwind asset purchases to help keep inflation low, otherwise known as Fed tapering.

Notably, Fed tapering and QE is hotly debated among economists. Those in favor say QE is a critical tool for stimulating the economy. Those against say that it inflates asset prices and contributes to inequality.”